Creating clear, practical handbooks on managing Cost+ contracts helps teams maintain efficiency, accountability and transparency across projects.

Energy Infrastructure Sector

Cracking the

Cost+ Code

Cost+ contracts are gaining traction in the energy sector as a flexible solution for high-risk, high-stakes projects. But without the right strategy, they can spiral into inefficiency and overspend. Forward-thinking organizations are now turning procurement into a performance tool-using smarter governance, clearer oversight, and sharper financial control to make Cost+ work for them, not against them.

Infrastructure projects, especially in the energy sector, operate in fast-changing market conditions with fluctuating supplier pricing and evolving technical requirements. In high-uncertainty environments, traditional fixed-price contracts can be too

rigid, creating risks that drive up costs and slow progress. Cost+ models offer a more flexible alternative, allowing organizations to share risks, adapt to shifting demands, and secure the right expertise when needed.

Despite these advantages, Cost+ contracts aren’t without challenges. Limited visibility into cost drivers, governance gaps, and

communication issues can lead to rising expenses and operational inefficiencies. Without effective governance

models and regular, transparent updates from contractors, organizations may struggle to maintain oversight and control over costs.

Additionally, complex project designs and specialized technical needs can make it harder for contractors to deliver, reducing vendor interest and increasing reliance on singlesource suppliers. To overcome these hurdles, organizations need a more strategic and structured approach to procurement transformation.

Successful procurement transformation isn’t just about cost cutting, it’s about creating a system that improves efficiency, transparency, and long-term control. The key objectives for organizations include:

![]()

Enhancing transparency

Full visibility into procurement activities helps organizations make informed decisions and manage budgets effectively.

![]()

Improving governance

Clear structures define roles, streamline processes, and reduce ambiguity.

![]()

Optimizing costs

Diversifying suppliers and leveraging market analysis help control rising expenses.

![]()

Strengthening financial controls

Efficient invoice verification, better cashflow forecasting, and accurate cost tracking reduce financial uncertainty.

![]()

Promoting knowledge transfer

Creating practical tools, resources, and best practices ensures teams can maintain procurement excellence in the long run.

Creating clear, practical handbooks on managing Cost+ contracts helps teams maintain efficiency, accountability and transparency across projects.

Flexible contract models like Cost+ arrangements offer a practical solution for managing complex, high-risk projects. By reimbursing contractors for actual costs plus a fee, organizations can secure resources, share risks, and keep projects moving forward. However, the success of these contracts depends on strong governance and clear oversight.

For example, integrating real-time dashboards and data-driven tools into procurement operations gives stakeholders upto-date insights into costs and risks. Creating clear, practical handbooks on managing Cost+ contracts helps teams maintain

efficiency, accountability and transparency across projects.

Strategic procurement practices built on flexibility, governance, and transparency allow organizations to successfully manage complex infrastructure projects. As Timo Grund, Managing Director & Partner for Energy at BCG, highlights, taking a collaborative, hands-on approach enables companies to build long-term partnerships with contractors, achieve significant cost savings, strengthen financial stability, and reduce project-related risk at the same time.

As the energy infrastructure sector continues to evolve, organizations that embrace smarter procurement strategies will not only control costs but also gain a competitive edge in delivering large-scale projects successfully.

Achieving cost excellence is no longer optional; it’s a strategic necessity.

At the center of this transformation is Stephan Kunigk, Chief Procurement Officer at Amprion, one of Europe’s leading transmission system operators. Kunigk has led a bold shift in procurement, turning it into a central force for delivering both economic and sustainability goals.

Here, Kunigk shares how Amprion restructured its procurement to drive efficiency, resilience, and long-term value in a rapidly evolving energy landscape.

What triggered your company’s shift toward a more strategic procurement model?

Initially, it was all about securing materials and services on time. But as costs rose and complexity grew – especially around EPCI contracts – we needed to think bigger. We pivoted to a crossproject and category-wide sourcing strategy. Instead of buying project by project, we consolidated demand to gain leverage, take a long-term view on supply, and reduce costs at scale.

Did that involve reshaping the supplier market?

Yes. Especially in civil construction where suppliers couldn’t meet our capacity needs. We helped them form consortia, sometimes between direct competitors, which was new in

our market. We also moved from rigid tenders to long-term contracts with value-sharing mechanisms. It wasn’t just about price – it was about building sustainable partnerships.

Collaboration between procurement and engineering can be tough. How did you establish it?

We started by shifting mindsets. Procurement was seen as back office. But with billions in spend at stake, fragmented thinking became a risk. We unified procurement, engineering

and controlling into one process. It took trust, transparency, and early proof-points to build alignment. Leadership and engagement were essential – transformation was driven by people, not just systems.

What role did data and technology play in achieving cost excellence?

A huge one. We had no single source of truth – data was everywhere. So, we centralized it with platforms like SAP Ariba and built dashboards to track spend, risks, savings,

and forecasts. This gave us visibility to act faster and more strategically. We standardized KPIs to measure impact.

How do you balance cost targets with sustainability goals?

ESG is integral. Most of our funding now comes from green bonds. About 90% of our CO2 footprint lies in our supply chain. So, we’ve integrated CO2 pricing into our evaluations and use tools like EcoVadis for supplier assessments. We align cost efficiency with climate goals – it’s not a trade-off but a requirement.

Have your contracting strategies evolved as well?

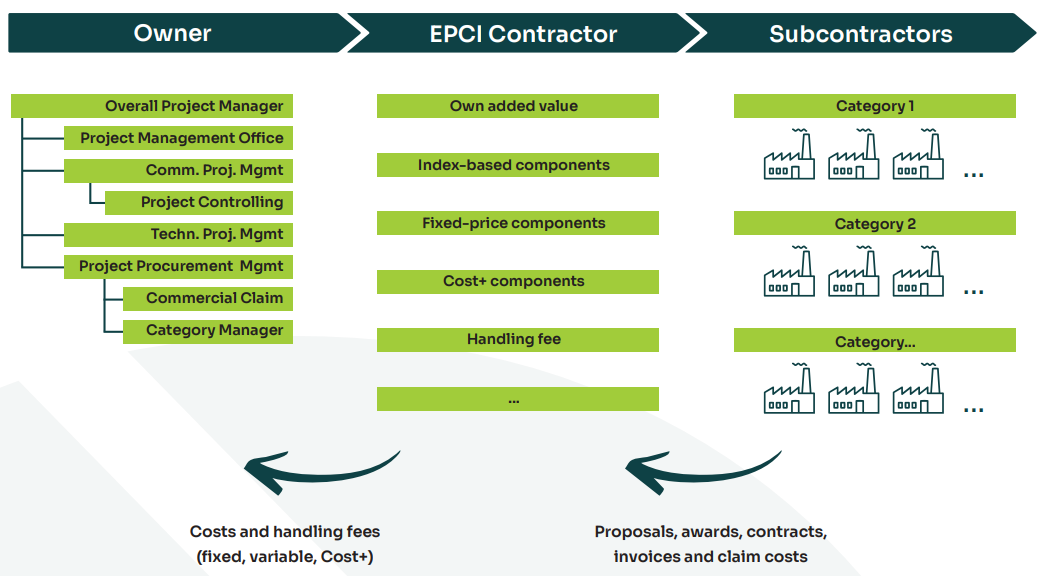

Absolutely. We’ve moved away from classic turnkey EPCI to more flexible frameworks. Sometimes using Cost+ models where risk is shared. We focus on long-term relationships –

setting basic terms first, then refining project specifics together. It’s more adaptable and fosters collaboration.

Looking ahead, what are the biggest challenges for procurement in energy?

Talent and time. We need skilled professionals who understand energy, data, and global supply chains. We also need clear longterm political direction. But the market is growing and new suppliers are entering, creating new opportunities. The key is staying agile while planning for the long game.

How is your team preparing for those future demands?

We’ve grown rapidly. Our focus now is on upskilling, market intelligence, and mapping supply chain risks beyond tier 1. The goal is resilience through data and insight, not just scale.

Reflecting on your journey, what were the biggest lessons?

First, get executive commitment early. Then, don’t get stuck in process design – focus on people. Communicate often. I personally met with every department to align goals. That

built trust. In the end, procurement transformation isn’t about software or templates – it’s about leadership, credibility, and delivering lasting value.