Private label is where procurement can truly bring its full toolkit to bear – drawing on a broader set of levers to shape value, speed, and supply chain resilience.

Is Private Label Your Biggest Margin Lever in Food Retail?

Private label isn’t just a cheaper alternative – it’s the most effective margin lever in modern retail. But to unlock its full potential, you need to move beyond simply rebranding products with new packaging and instead develop a holistic sourcing strategy tailored to your private label brand.

Amid inflation, evolving consumer expectations, and continued supply chain disruptions, the role of private label is being redefined. While cost efficiency has always been foundational, private label is now a strategic centerpiece – not just a supplementary lever. Retailers are no longer launching own brands merely to fill shelf space or offer alternatives; they’re doing it to protect margins, mitigate input cost volatility, and strengthen their negotiating position with national brand suppliers.

Yet many still fall short – treating private label as a branding play rather than a sourcing strategy. The leaders take a different path: embedding private label into the core of procurement to drive cost transparency, supplier competitiveness, and operational discipline.

The takeaway for CEOs: private label remains one of the most underutilized profitability boosters – capable of generating up to twice the margin of national brands when it is strategically structured and driven by procurement.

According to our BCG Consumer Practice, we are entering a phase where “the best private label brands won’t be alternatives – they will be category leaders”.

![]()

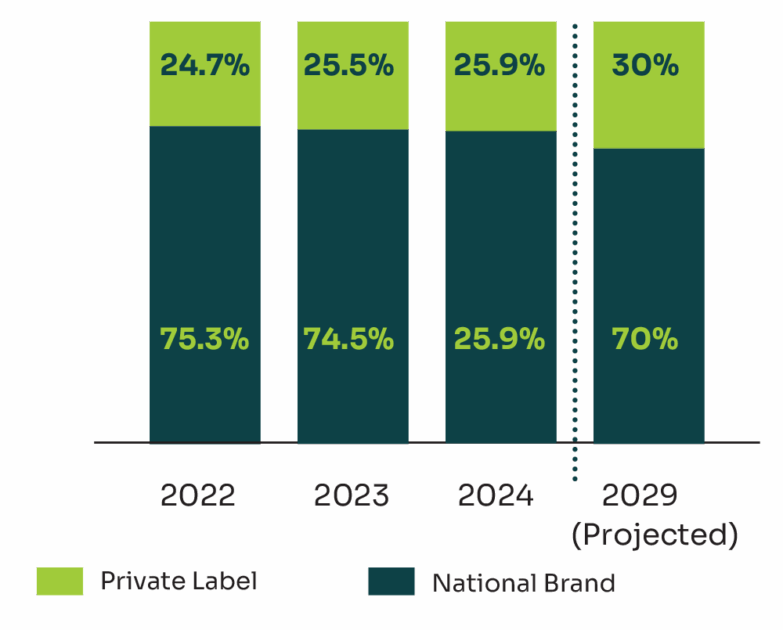

Private label is gaining new momentum in grocery: in the first half of 2024, it accounted for 20.4% of US grocery sales by value – up three points in just 18 months.

But this isn’t just about consumers trading down. The rise of private label reflects both a shift in shopper behavior and a strategic recalibration by retailers. Private label has fundamentally evolved:

Consumer perception: shoppers increasingly view private label as comparable with national brands in quality, value, and sustainability.

Retailer strategy: with growing pressure on margins, retailers are leaning into private label to gain greater control over product costs and the broader value chain.

Brand building: the evolution of private label into a brand-building tool is well underway – with retailers continuing to expand premium, organic, and mission-driven lines to stand out in saturated markets.

Yet here’s the catch: private label prices have also risen. Across European markets, consumers are increasingly questioning whether private label still delivers the value it promises – particularly as store-brand prices in some categories have risen faster than those of brands.

The reality? Private label can still deliver real value – but only when the sourcing model is engineered to do so.

That means strategic supplier development, constant cost benchmarking and design-to-cost thinking. In fact, top-performing retailers like Costco (with Kirkland Signature) and Target (with Good & Gather) have proven that own-brand excellence – built on disciplined cost management – can also drive loyalty and growth.

At Inverto, we’ve delivered concrete sourcing shifts – anchored in data, cost logic, and structured implementation.

A €3bn online grocery retailer, for example, partnered with Inverto to redesign its private label sourcing model. By applying TCO models, streamlining specifications, and optimizing its supplier base – including introducing dual sourcing to reduce supply risk – it unlocked over €20 million in annual savings without compromising product performance.

In another case, a global pet food retailer restructured more than 100 SKUs across its private label portfolio. By combining conjoint analysis and benchmarking against branded products, we helped deliver a +4pp margin improvement by aligning product specifications with actual perceived value.

These examples reflect a broader pattern: successful retailers don’t just treat private label as a product line – they treat it as a sourcing strategy. This includes how they negotiate – with clear cost models, clean benchmarks, and a commercial logic that aligns pricing discussions to structural value.

So, what separates good private label sourcing from truly high-performing models? These five questions reflect the behaviors we see most often among category leaders.

Private label success in food isn’t just about launching products – it’s about sourcing them strategically. These five questions reflect where leading procurement teams are focusing their efforts to unlock margin, speed, and supply resilience in food private label.

Unlike brands, which often pass rising costs on to consumers, private label gives retailers greater control over pricing and value delivery. This makes it even more urgent for retailers to optimize their sourcing strategies.

The opportunity lies in smarter sourcing: building cost transparency, applying consistent cost governance across the product life cycle, and embedding margin thinking into every product from the outset – not as a financial target, but as a sourcing

principle. This is where GenAI starts to make a difference – when paired with clean, structured data. While GenAI can already drive value with high-level inputs, its real potential emerges when retailers invest in strong data foundations: centralized, integrated platforms for product, supplier, and cost information that create a single source of truth for decision-making.

Together, these enablers allow procurement teams to compress sourcing timelines, optimize spec design, and drive margin from insight – not just instinct. But technology alone won’t shift the margin needle. Retailers will only succeed if they pair these tools with a sourcing-led mindset – where procurement takes the lead in defining cost targets, shaping brand architecture, and building private label portfolios that compete on value and agility. That mindset must also embrace supplier collaboration – not just as a transactional relationship, but as a strategic partnership. Joint product redesigns, co-innovation, and incentive-aligned development roadmaps can drive efficiencies that individual players can’t unlock alone.

In many food categories, private label won’t just match brands – it will lead on margin, speed, and customer relevance. And it will be procurement that gets it there.