Unlocking Procurement Synergies to Maximize M&A Value

Inverto partners with private equity, principal investors, and corporates to unlock the full synergy potential of mergers and acquisitions, delivering rapid, sustainable value from day one.

of PMI value through procurement

Projects with PE partners

PMI projects

Are You Ready to Capture the Value?

After a period of subdued deal activity, Merger & Acquisition (M&A) transactions are expected to accelerate. With private equity firms holding record levels of dry powder, competition for quality assets is intensifying. Yet, 70–90% of acquisitions fail to achieve their intended value due to integration challenges.

For current market context, we reference BCG’s M&A Sentiment Index—a forward-looking, monthly gauge of dealmakers’ willingness to transact—so readers can see the latest outlook without this page needing updates.

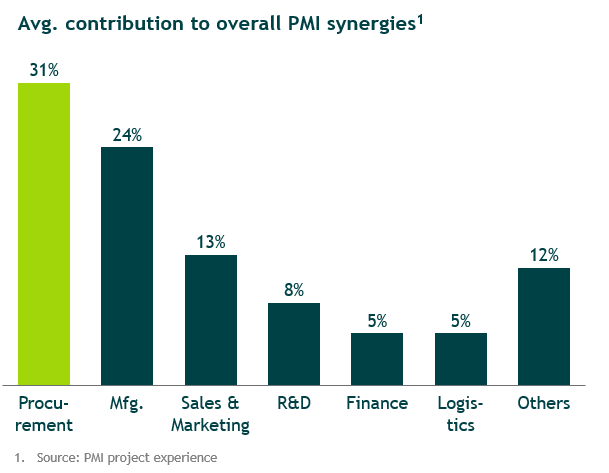

Post-Merger Integration (PMI) is the critical success factor – and procurement is at the heart of synergy realization, contributing up to 31% of total PMI synergies.

- Achieving economies of scale

- Consolidating supplier networks

- Implementing process standardization

- Reducing redundancy in supplier base

Our PMI offering is tailored to the unique needs of private equity investors and their portfolio companies:

- Maximizing Procurement Synergies – Consolidating suppliers, renegotiating contracts, and optimizing category management.

- Reducing Supply Chain Risks – Ensuring resilience, compliance, and continuity during integration.

- Optimizing Working Capital – Improving payment terms, inventory, and supplier financing. Also see our Working Capital white paper.

- Supporting PMI Due Diligence – Using state-of-the-art tools such as the PMI Synergy Evaluator to provide targeted procurement insights, quantify synergy potential, and track value realization.

- Value Delivery – Identify and prioritize synergies, from consolidating suppliers and harmonizing contracts to building a combined spend cube and optimizing category strategies. We focus on rapid wins while safeguarding long-term value creation.

- Organization – Align leadership, integrate teams, and clarify roles to enable fast decision-making. We also define the target operating model, ensure Day-1 readiness, and establish governance structures to keep integration on track.

- Enablers – Put the right systems, processes, and change management measures in place, such as IT integration roadmaps, synergy tracking dashboards, and talent retention plans, to secure sustainable results.

We guide you from pre-close planning to post-close execution, tailoring our approach to the specifics of your deal, industry, and strategic priorities. The result: a seamless integration that protects business continuity, accelerates value creation, and lays the foundation for sustained performance.

Accelerating Synergies with Data, AI and experience in shortest time

Effective post-merger integration depends on quickly building a shared fact base and translating it into actionable plans. Inverto applies proprietary tools, such as the PMI Procurement Synergy Evaluator, to automate spend classification and harmonization across merging entities in less than a week. These tools draw on benchmarks from more than 1,000 integration projects, enabling rapid, evidence-based synergy estimates with minimal disruption to client teams.

The following examples illustrate the type of results achieved:

-

In the automotive sector, identified €320m in procurement synergies, exceeding the initial target within the first year.

-

For a healthcare merger, ideated €100m in savings, with double digit savings realized in year one.

-

In facilities management, identified €25m in value within six weeks through targeted category reviews.

These examples are representative of our experience across industries and transaction types, and demonstrate how analytical capabilities and execution expertise work together to support our clients’ integration objectives.

Why Partner with Inverto

Post-merger integration requires both strategic alignment and disciplined delivery. Inverto combines BCG’s global M&A expertise with deep functional capabilities in procurement and operations. Drawing on extensive cross-sector experience, we tailor each approach to the specific context of the deal, working alongside clients to design integration structures, mitigate risks, and capture synergies.

Gain deeper insights