Tariffs are now influencing not just sourcing costs, but strategic supply decisions.

This article draws on findings from the Inverto Raw Materials Study 2025, which surveyed over 200 procurement and business leaders across Europe. Approximately 18% of respondents represent the food industry, retail and wholesale trade.

The study offers a strategic snapshot of how organizations are navigating an increasingly complex sourcing landscape, revealing a clear shift—from reactive responses to structural resilience, enabled by regionalization, smarter pricing models, and digital innovation.

Procurement at a Crossroads: Why Consumer Goods Leaders Must Act Now

In the boardrooms of Europe’s leading food and consumer goods companies, a new reality is setting in. Supply volatility and external shocks—once considered cyclical risks—are increasingly becoming part of the ongoing strategic environment. This shift extends procurement’s role beyond cost and supply management, adding new implications for broader business resilience.

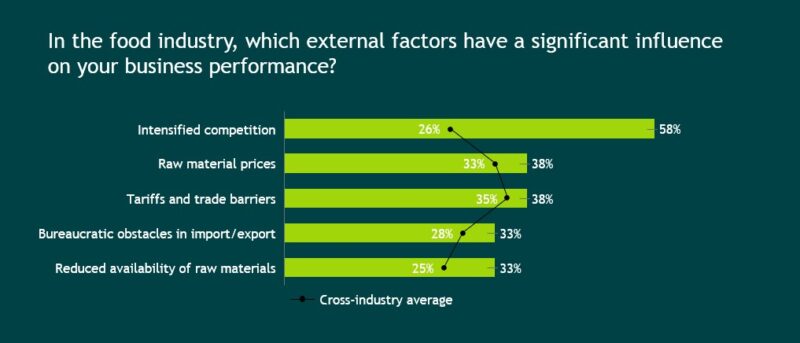

Competition—always fierce in the consumer goods sector—has reached new heights: 58% of companies cite intensifying competition as a critical concern in 2025, nearly triple last year’s figure and well above the cross-industry average of 26%.

At the same time, long-standing assumptions around cost and supply stability have weakened. Raw material costs are climbing, cited as a key issue by 38% of industry players. Tariffs and trade barriers, barely on the radar in the past, are now front and center—rated as the top external risk by 38% of sector leaders.

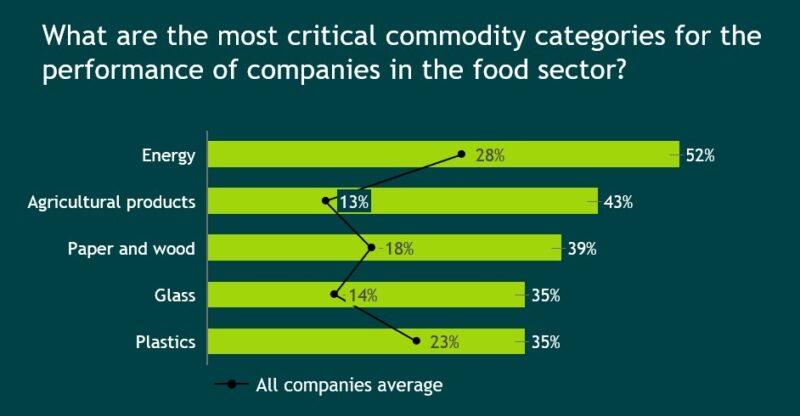

But that’s not all. Bureaucratic obstacles to import and export have jumped to 33%, and raw material availability has doubled as a concern, cited by a third of companies in the sector. Energy, agricultural products, and packaging are all under pressure—creating a perfect storm that leaves few businesses untouched.

The data suggests a widening need for strategic adaptation: 69% say raw materials now account for up to 60% of their purchasing volume. And while 81% source from tariff-affected regions, less than half have adapted their strategies. This indicates a meaningful gap between increasing risk awareness and the level of action taken so far.

For consumer goods leaders, the message is clear: the playbook of the past no longer applies. Structural resilience, not routine, will define the winners of tomorrow.

Building Structural Resilience—What It Takes in Consumer Goods

For years, procurement teams in the food and consumer goods industry prided themselves on cost discipline and contract negotiation. Today, those skills alone are no longer enough. The world has moved on: procurement is now a cross-functional architect of resilience and competitiveness.

What’s changed? Tariffs are now influencing not just sourcing costs, but strategic supply decisions. Competition isn’t just stiffer; it’s reshaping entire value chains, as new players and challengers fight for market share. Regulatory pressure, from border bureaucracy to ESG mandates, is raising the bar for compliance and transparency.

In this new era, the winners are those who turn these external pressures into a platform for innovation, agility, and growth.

But what really sets industry leaders apart isn’t just their use of digital tools; it’s a fundamental shift in mindset—from passive risk monitoring to proactive scenario planning, from incremental tweaks to bold redesigns. These organizations aren’t waiting for disruptions to force their hand. They’re using insights to shape strategy, not just track it, and are willing to challenge legacy practices in pursuit of real resilience.

Turning Turbulence Into Strategic Edge for Consumer Goods Leaders

The lesson for C-level leaders is clear. Volatility is not a passing phase; it is the new normal. Waiting for stability is a losing bet. The companies that move with urgency—building structural resilience, digital agility, and supply flexibility—will not only weather today’s storm but capture the opportunities within it.

Whether you’re refining a solid foundation or pursuing best-in-class performance, now is the moment to advance your procurement strategy. The stakes for consumer goods have never been higher, nor the rewards for getting it right more tangible.

Building Structural Resilience—What It Takes in Consumer Goods

What separates those who thrive from those who merely survive? At Inverto, our experience with top consumer goods clients reveals three decisive moves.

First, sector leaders are fundamentally rethinking their supply networks for a more regionalized and robust future. One in three food industry companies is planning to restructure their global supply chains, placing greater emphasis on regional proximity.

Another third is considering relocating parts of their production footprint to dampen the impact of tariffs. In high-impact categories—energy, agricultural products, and packaging—this shift is already redefining procurement strategies.

Second, the most advanced organizations are moving beyond pure cost control by embedding innovation and flexibility at the heart of their operations. Early, cross-functional collaboration between procurement and R&D is driving material substitution and agile product redesign, so that resilience is not an afterthought, but built in from the very first design brief.

For example, a leading European pet food retailer partnered with us to transform its own-brand business by tackling raw material and packaging costs head-on.

Through a cross-functional “design-to-value” program, procurement, product development, and suppliers worked together to reverse-engineer recipes, benchmark ingredients, and redesign products to enable smarter material choices and greater supply flexibility.

This fact-based approach to material substitution, cost transparency, and supplier negotiations delivered over €17 million in savings and lifted margins by more than 3 percentage points—setting a new benchmark for resilience and value in a highly competitive market.

Finally, digital transformation is no longer a side project—it is the backbone of future-ready procurement. The rapid adoption of GenAI-powered tools and advanced analytics is unlocking new value: giving leaders the ability to steer their supply chain based on real-time facts, simulate scenarios, and react faster than the competition.

This data-driven mindset isn’t just about efficiency; it’s about unlocking cost improvements of 3 to 8 percent—even in the most turbulent categories—and building a foundation of resilience that will endure far beyond today’s market cycle.

Download the full white paper for free:

Fill out the contact form below to receive the complete study by email.