Europe’s Tariff Landscape

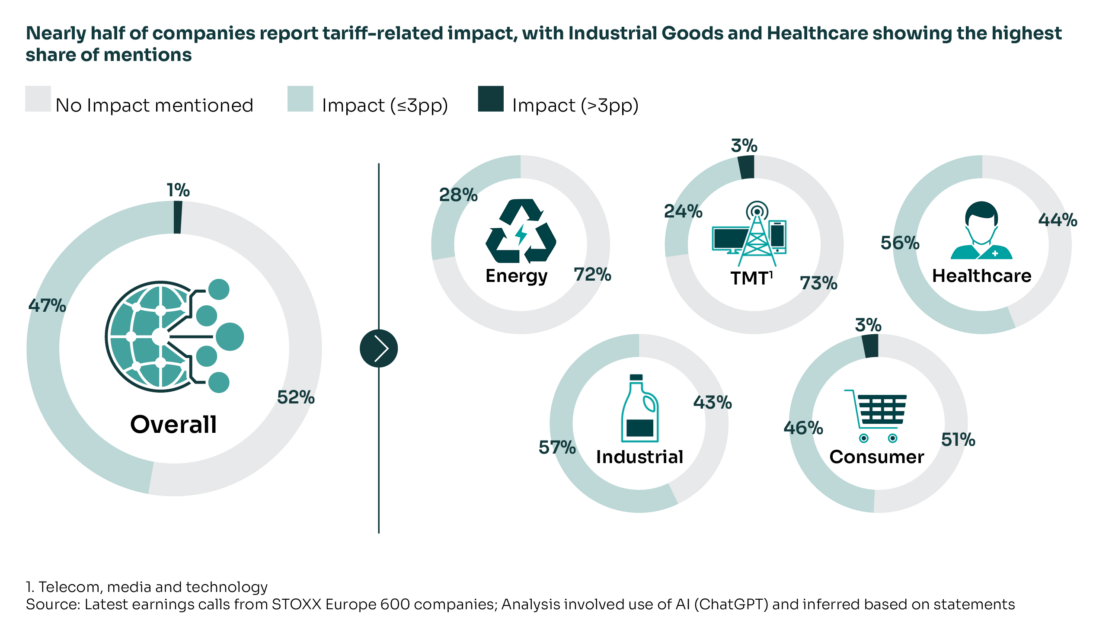

Across Europe, tariff concerns have shifted from peripheral long-term risks to central elements of executive decision-making. In our review of more than 200 earnings calls from the largest STOXX Europe 600 companies, excluding Financial Institutions and Insurance, nearly half of companies indicated that they are already experiencing tariff impacts today.

The view from the United States is even more pronounced: among about 250 analyzed earnings calls from Fortune 500 companies, four out of five reported tariff effects directly influencing EBIT. A notably larger share also highlighted material EBIT pressure of more than 3 percentage points (3% in the U.S. sample vs. 1% in Europe).

The message is clear: tariff dynamics are no longer a background risk. Both U.S. and European companies must actively anticipate and manage tariff exposure to protect competitiveness.

Sector Analysis: Industrial Goods, Healthcare, and Consumer Most Exposed

Sector patterns reveal meaningful differences in exposure. In Europe, industrial goods (57%), healthcare (56%), and consumer (49%) show the highest share of tariff mentions—a sign that these industries face broad-based and recurring impacts. For leaders in these sectors, tariff mitigation is no longer optional; it must be prioritized as a strategic capability.

By contrast, energy (28%) and TMT (27%) show comparatively lower exposure based on earnings-call insights.

The U.S. picture follows similar contours, though with even sharper effects—particularly in Energy (87%), where tariff risk has become a persistent operational concern.

How European Executives Are Responding

European executives are not only acknowledging tariff pressures—they are taking tangible steps to mitigate risk and build long-term resilience. Most companies combine multiple levers to balance short-term cost protection with structural improvements.

The most frequently cited response is shifting production and sourcing closer to end markets. Companies are reducing reliance on single geographies, especially those exposed to trade tensions, and broadening their supplier base to ensure continuity and flexibility.

Where feasible, firms are adjusting customer pricing to offset tariff-related cost increases. While conditions vary by industry, pricing agility is increasingly viewed as essential for margin protection.

Executives highlight targeted operational upgrades—optimizing logistics networks, redesigning transport flows, and streamlining internal processes. Some also emphasize structural enhancements: more modular product designs, flexible contracting models, and strengthened commercial setups.

A smaller share leverages available exemptions or relief programs, working with regulators to reduce exposure while ensuring compliance.

Europe vs. North America: Three Distinct Differences

Three insights consistently emerge when comparing the two regions:

-

Severity of impact

U.S. companies report a higher frequency of tariff mentions and a greater EBIT impact than their European peers.

-

Sector exposure

While European companies reported the strongest effects in industrial goods, healthcare, and consumer sectors, U.S. companies are experiencing particularly strong exposure in Energy alongside Healthcare.

-

Strategic orientation

European firms focus more on structural levers such as local sourcing, diversification, and customer pass-through. North American companies place stronger emphasis on reshoring, domestic-content compliance, and organizational agility.

Conclusion: A Deliberate and Resilient European Playbook

Tariffs can no longer be treated as temporary, unpredictable disruptions—they must be embedded as a core component of procurement and supply-chain strategy.

European companies are already strengthening resilience through diversified sourcing models, more flexible pricing approaches, operational excellence, and targeted use of policy exemptions. U.S. companies are accelerating domestic or USMCA-compliant sourcing, reassessing exposed product lines, and tightening compliance with domestic-content rules.

As global trade dynamics continue to shift, companies that invest early in tariff resilience will not only safeguard performance but also unlock a meaningful competitive edge. Now is the time for leaders to act decisively and shape the future of their supply chains—before external pressures shape it for them.

Gain deeper Insights