Cost Pressure Meets Climate Ambition:

How to Fund the Sustainability Journey

Across industries, leaders are feeling the squeeze. Inflation, geopolitical instability, and slowing growth have put cost management firmly back on the executive agenda. At the same time, companies are under increasing pressure to deliver on their sustainability commitments.

Many organizations have treated sustainability as a “nice-to-have” – important, but secondary to near-term performance. Yet that perception is shifting.

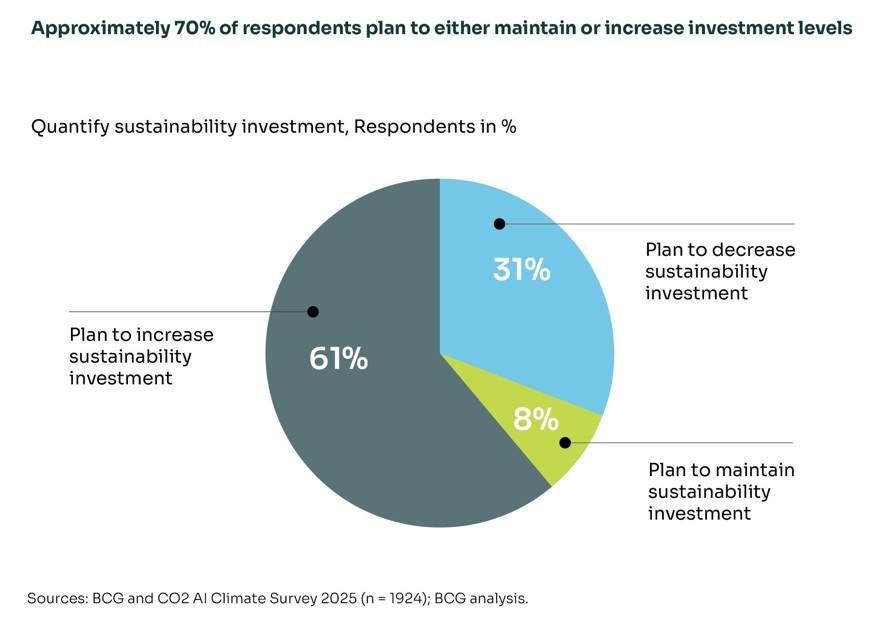

Most companies now plan to increase investment in sustainability over the next five years, recognizing that climate resilience is no longer optional.

For Chief Procurement Officers and business leaders alike, this moment presents a powerful opportunity: to treat sustainability not as a cost center, but as a self-financing growth engine.

From Cost Control to Climate Catalysis

Procurement has always been the engine of efficiency. But today, it also needs to be the engine of transformation. The next wave of climate action will not be funded through new budgets or corporate philanthropy; it will be financed through smarter cost management.

By linking cost and carbon, procurement can fund sustainability investments while protecting profitability. This dual approach, aligning efficiency with environmental ambition, positions procurement as both the guardian of margins and the catalyst of transformation.

In practice, that means:

- Reinvesting efficiency gains from spend optimization, supplier collaboration, and smarter sourcing into decarbonization programs.

- Designing cost-and-carbon initiatives that improve both the P&L and the company’s environmental footprint.

- Embedding sustainability criteria into sourcing and supplier selection, building long-term resilience and competitive advantage.

This is how cost discipline becomes a lever for lasting change.

Why the Timing Is Right

After several years of crisis management, executives are regaining the visibility and confidence to think long term again. At the same time, a growing body of evidence shows that sustainability delivers measurable business value.

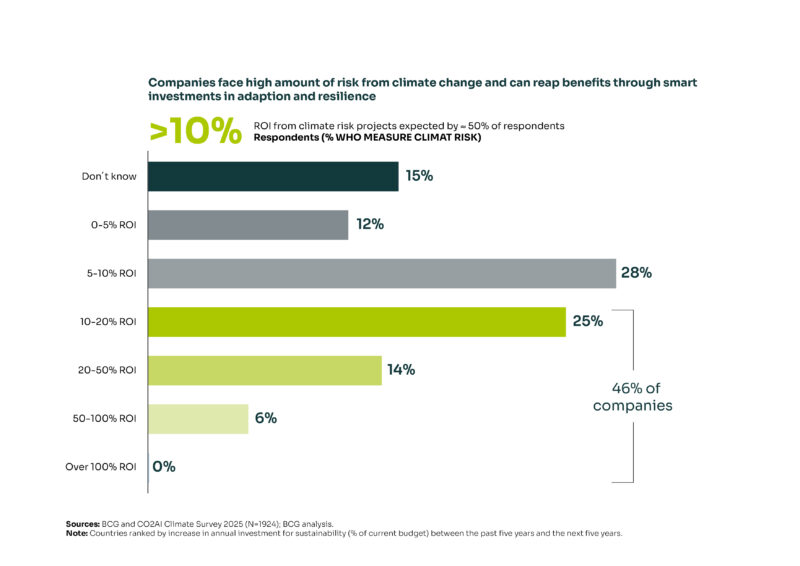

Companies that have embedded decarbonization and adaptation into their strategies are already seeing tangible financial returns, from operational cost savings and risk mitigation to stronger customer loyalty and investor confidence. Many are achieving double-digit ROI on sustainability initiatives.

The lesson is clear: sustainability is no longer an investment with uncertain payback. It is one of the most reliable pathways to value creation and resilience.

Sources: BCG and CO2 AI Climate Survey 2025 (n = 1924); BCG analysis.

How to Fund the Journey

To make sustainability financially sustainable, organizations must integrate cost and carbon into one management system. The “Fund the Journey” approach identifies four ways to do this effectively.

Every cost-saving initiative can become a funding source for climate action.

By reinvesting operational savings from sourcing optimization, automation, or energy efficiency, companies can directly finance decarbonization projects such as renewable energy adoption, fleet electrification, or supplier transition programs.

This creates a green reinvestment loop, where savings captured through productivity improvements or waste reduction are redirected into long-term sustainability goals. It is a simple but powerful principle: use today’s efficiency to fund tomorrow’s transformation.

The economic case for climate action has never been stronger.

Successful companies are quantifying the full financial impact of sustainability, from lower energy and material costs to avoided carbon taxes, supply chain resilience, and improved access to green financing.

By measuring and communicating these outcomes, leaders can reposition sustainability from a compliance exercise to a strategic growth lever that strengthens both profitability and enterprise value.

The most effective climate programs deliver cost and carbon benefits simultaneously.

Procurement teams can reshape their decision-making frameworks to assess every initiative through both economic and environmental lenses.

Key levers are:

- Amplify net-saving actions such as renewable energy sourcing, circular product design, and supply chain waste reduction.

- Make high-cost initiatives cheaper through supplier innovation, competitive sourcing, and scale efficiencies.

- Enhance investment confidence by using data and digital tools to forecast returns and de-risk major decarbonization projects.

Leading organizations are formalizing the funding process through green reinvestment funds, internal mechanisms where a portion of procurement savings or avoided costs is ringfenced for future sustainability projects.

These funds are typically co-owned by Finance, Procurement, and Sustainability functions, ensuring transparency, discipline, and measurable outcomes. They turn sustainability into a self-reinforcing cycle: savings fund action, action drives further savings, and the journey accelerates.

Path Forward

Procurement is uniquely positioned at the intersection of cost, risk, and sustainability impact. By embracing its dual mandate, cost discipline and climate ambition, procurement can redefine its role from cost controller to financial architect of the sustainability transition. This is a profound shift: from optimizing spend to unlocking customer value and driving competitive advantage through sustainability.

The sustainability journey is not about spending more; it’s about spending smarter. By unlocking the link between value creation and decarbonisation, companies can finance their transformation from within, creating value for shareholders, customers, and society alike. It’s time for procurement to help fund the sustainability journey.

Gain deeper Insights