The energy sector is facing intensified pressure to secure resilient and cost-effective supply. With competition rising and global supply disruptions putting pressure on sourcing, even experienced procurement teams are finding that conventional negotiation tactics fall short. Energy companies need a new way to navigate this complexity.

- Supply chain disruption, geopolitical risk, and growing infrastructure demand are creating supply bottlenecks that traditional negotiations struggle to address.

- Weak BATNAs and heightened competition from global buyers are shifting bargaining power toward suppliers.

- A game theory-based negotiation approach can help energy companies create value, strengthen alternatives, and secure better outcomes.

Rethinking Negotiation Strategy for the Energy Sector

In this environment, game theory offers a practical framework for energy companies to rethink negotiation dynamics. It breaks the process into two strategic steps: first, creating value to attract suppliers; second, capturing that value through a structured strategy that both builds leverage and creates viable alternatives.

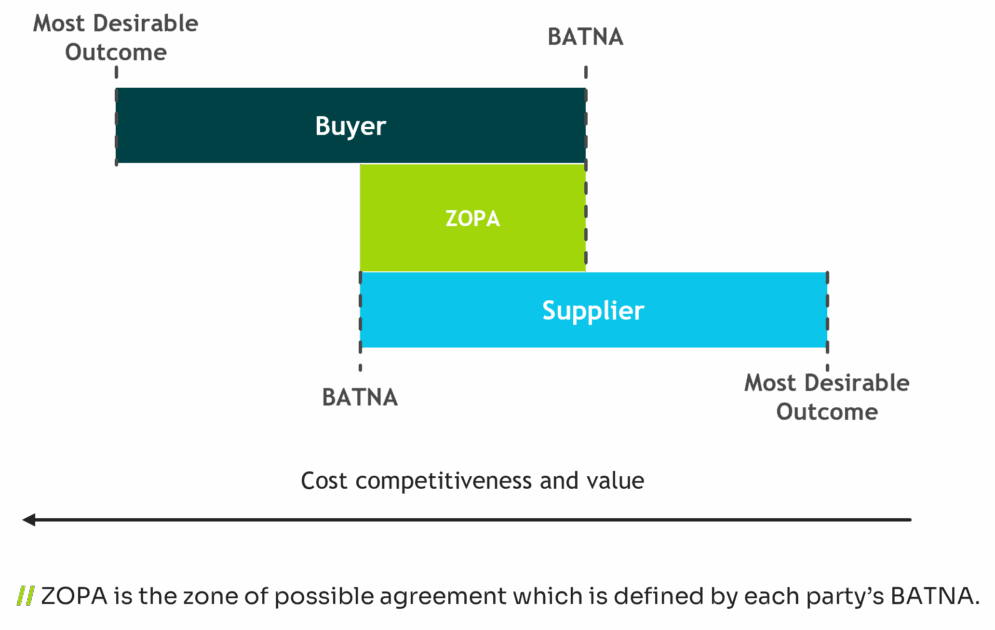

The overall success in negotiations hinges on thorough preparation, and an important part of it is clear understanding of alternatives. Specifically, BATNA or the best alternative to a negotiated agreement. This defines the walk-away position and thus ensures that the negotiation outcome, when reached, is indeed favorable.

As each negotiating side has their own BATNA, an agreement can be reached in the first place only if it’s better than the BATNAs of those involved. The outcomes that meet this criterion fall into the so-called zone of possible agreement or ZOPA. Which of those possible outcomes occurs in the end depends on negotiation dynamics.

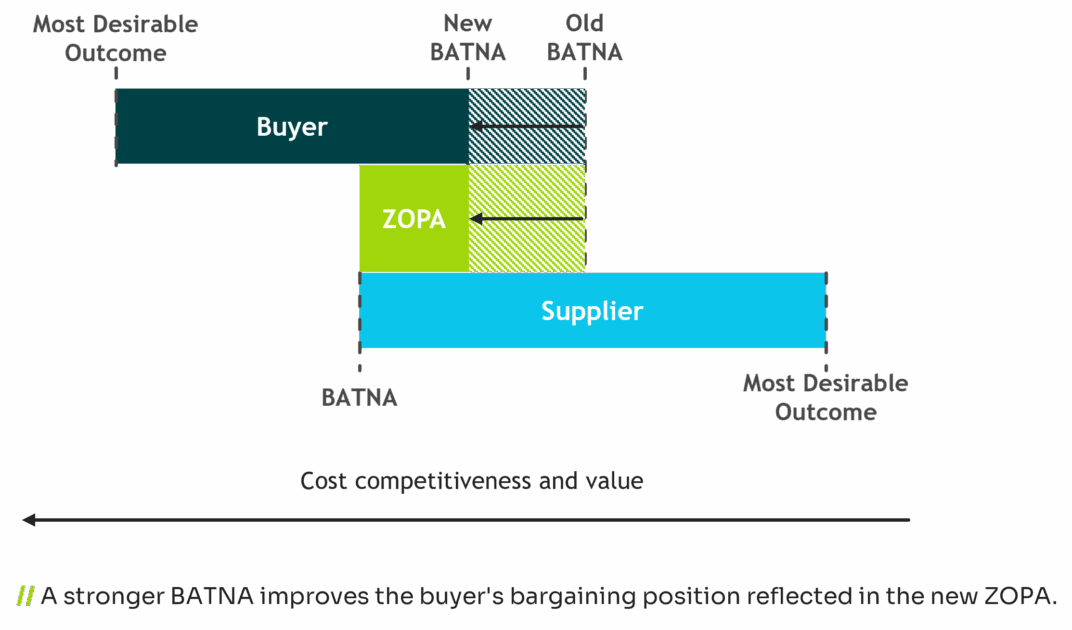

What can be done to secure a better outcome is to create the strongest BATNA before any negotiations begin. Doing so narrows the other party’s acceptable range and improves one’s position within the ZOPA, increasing the likelihood of securing a more favorable agreement.

However, what happens when a negotiator cannot clearly establish a BATNA?

This challenge of negotiating with a weak or non-existent BATNA is becoming increasingly common in the energy sector. Heightened competition for scarce resources arising from the global energy transition creates a landscape where conventional negotiations struggle to balance business needs in terms of cost competitiveness, long-term value creation, and supply continuity.

The Energy Supply Challenge

A Case in Electrical Cables

Consider electrical cables, a critical component of the green energy transition. The shift to renewables is driving major investment in network infrastructure, significantly increasing demand for electrical cables and creating favorable market conditions for suppliers. When demand rises without a proportional increase in supply, prices surge.

This issue is compounded by global supply chain disruptions, current geo-political issues, and raw material shortages. Even with a robust strategy behind, procurement professionals find themselves hard-pressed to negotiate not only on cost but also availability, lead times, and supplier commitments critical to project timelines.

We explored these dynamics in more detail in our article on navigating the power cable supply crunch. Overcoming these challenges can benefit from a more analytical, structured and strategic approach to key negotiations. Game theory offers a powerful framework to approach these negotiations and build leverage, even in uncertain and complex markets.

Game Theory Approach

From the point of view of game theory, energy companies need to improve their bargaining position, especially in supply markets with intense global or local competition for limited resources. Competing buyers, willing to pay premiums to secure scarce materials, further weaken energy companies’ bargaining position by becoming attractive alternatives (BATNAs) for suppliers.

To improve their bargaining position, energy companies must differentiate themselves in the market in ways that also strengthen their alternatives (BATNAs), and game theory offers a framework to achieve this through a structured two-step approach.

1. Increasing the pie (value creation) – identify and deploy levers to make the business opportunity more attractive to the market. This lays the groundwork for building alternatives and increasing energy companies’ bargaining power.

2. Splitting the pie (value capture) – design and implement a negotiation strategy that leverages alternatives to optimize how value is distributed. Such a negotiation strategy focuses on utilizing the built-up bargaining power to its full potential.

The first step focuses on value creation, by deploying levers that expand resources or options for all parties. To increase the pie, energy companies should look at what are traditionally called “win-win” opportunities, as well as assessing further opportunities where the costs to one party are lower than the consequent gains to the other party.

In a market where multiple companies are vying for limited resources, energy companies’ priority lies in increasing the strategic value they bring to the market, in this way differentiating themselves from other players in the market without paying premiums.

From a game theory perspective, it is essential for energy companies to place themselves in the other party’s shoes. This involves analyzing and understanding supplier’s motivations, interests and alternatives to derive potential levers to increase strategic value. Examples of potential levers include:

- Shift the partnership model from transactional to strategic, offering privileged access to stakeholders, further business units and future business plans.

- Offer exclusive opportunity windows to retain current business by meeting benchmarks and/or acquiring new business prior to offering it to the market.

- Collaborate on development through co-innovation, specification standardization, and cost engineering initiatives.

- Leverage forecasting and volume commitments where demand predictability minimizes both parties’ risk.

- Bundle demand across time, projects, or regions to reduce risk premiums, unlock potential efficiencies and secure bulk discounts.

In the cables context, bundling demand can create entirely new alternatives that wouldn’t otherwise exist. In doing so, different negotiation scenarios can be drawn up and even if they are unattractive, their existence strengthens energy companies’ BATNA, ensuring a better outcome.

Creating value is only half of the equation. To secure favorable outcomes, energy companies must capture that value through a tailormade negotiation strategy. This leads us to the second step: splitting the pie, the art of creating and implementing the optimal negotiation strategy considering the constraints of the business and the market.

The elements that shape such a negotiation strategy come from the interplay of the different strategic factors that shape each party’s bargaining power. Understanding and managing these factors is essential to securing an optimal outcome, for example:

- Information control – Use information as a strategic tool to incentivize suppliers to be truthful and transparent, as well as to trigger concessions.

- Credible commitment – Use clear enforceable actions with transparent if-then consequences to signal intent and avoid “cheap talk”.

- Robust alternatives – Strengthen one’s BATNA by exploring replacement technologies, or relaxing internal constraints, to generate competition by admitting alternative suppliers while ensuring comparability between options.

- Strategic timing – Ensure that the negotiation timeline is synchronized with the overall strategy and is aligned with market trends, industry negotiation cycles, critical deadlines and business readiness.

- Role-playing – Conduct exercises to practice and refine the strategy ahead of the actual negotiation, anticipate potential responses and ensure all scenarios are covered.

When it comes to cables, timing and alternatives are especially critical. Energy companies must balance urgency with the need to cultivate and compare viable options, something conventional negotiation approaches usually struggle to address.

Authors: Daria Khromenkova Senior Project Manager, Pedro Aniceto Project Manager