Leading organizations build structured systems that link supplier performance to strategic priorities.

– Jan Mersmann, Principal

In many industrial sectors – especially automotive, engineered products, and heavy manufacturing – material costs account for 50–70% of total costs. That single figure makes the case: managing suppliers isn’t just operational hygiene, it’s a margin-critical capability.

Still, supplier performance is too often assessed as a one-time event rather than as a capability that must evolve over years. Even where formal systems exist, roles are unclear and follow-up is inconsistent. Short-term snapshots can’t reveal true contribution, progress, or risk. Short-term snapshots can’t reveal true

Amid supply chain disruptions, inflation, and rising ESG expectations, supplier performance has become a C-level agenda. It directly impacts profitability, resilience, and innovation.

In margin-sensitive industries, procurement is often the largest untapped value lever. But unlocking that value requires more than contract compliance, it demands structured control over supplier performance, behavior, and development.

While many companies still approach supplier management reactively, with inconsistent metrics, infrequent reviews, and loosely defined development plans, leading organizations have moved ahead. They’ve built structured systems that link supplier performance to strategic priorities, drive continuous improvement, and ensure accountability.

This shift isn’t just about compliance. It’s about realizing that supplier performance directly influences margin, innovation, resilience, and ESG progress, and must be managed accordingly.

That’s why forward-looking companies are embedding supplier management into their core operating model. Not as a one-off review process, but as a continuous performance cycle: tightly aligned with business objectives, supported by clear governance, and equipped to trigger improvement at scale.

Leading organizations build structured systems that link supplier performance to strategic priorities.

– Jan Mersmann, Principal

At the heart of a successful supplier management system is not just what gets measured, but how those measurements evolve, and how they shape behavior over time.

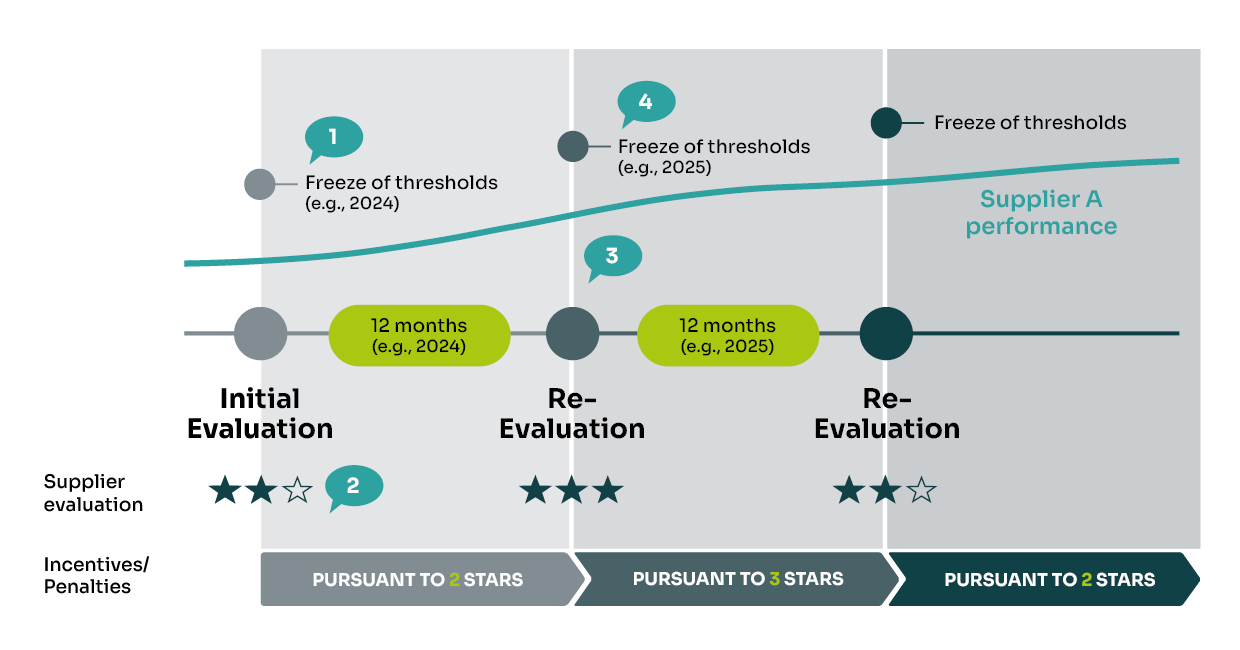

The example below illustrates Inverto’s self-adjusting performance logic, where evaluation thresholds, incentives, and supplier segmentation evolve in structured cycles, ensuring that expectations keep pace with performance, and that progress becomes self-reinforcing.

// Legend:

1 Assessment of relative supplier performance to set initial evaluation thresholds

2 Establish incentives or penalties according to performance assessment

3 Re-evaluation of supplier performance against initial evaluation threshold

4 Derive new evaluation threshold based on relative past 12-months supplier performance

The foundation of effective supplier performance lies in a closed-loop system — one that evaluates, develops, and re-evaluates suppliers over time. It enables consistent performance improvement, accountability, and alignment with business goals.

A key differentiator of this approach is the use of relative performance measurement. Many systems fail because suppliers are rated well against static or outdated targets — masking real issues. By benchmarking suppliers against peers, performance is contextualized, competitive pressure is applied, and continuous improvement is enabled.

This structured cycle turns supplier management into an engine of continuous value generation, tied directly to category management, negotiation planning, and sourcing execution.

In today’s environment, managing supplier performance proactively and systematically becomes essential. Not only to protect margins, but to ensure continuity, compliance, and innovation readiness across the value chain. Embedding supplier performance into governance also means enforcing consequences and applying incentives. Too often, companies document thresholds but fail to act on them.

What’s needed Now?

The structures and processes to translate supplier data into long-term performance, supplier development, and strategic clarity – year after year.