Portfolio companies experienced a significant increase in value in the first five years after being acquired.

Desk-Research Results

A ‘swarm of locusts’ or nothing of the sort?

Private equity firms have long been seen as ruthless profit-seekers who are rarely interested in developing their portfolio of companies in the long-term. They may be derided as profit-seekers, but it seems that these financiers still create opportunities. Our desk research into the performance of portfolio companies proves that they significantly outperform their competitors without private equity involvement.

German politician Franz Müntefering of the Social Democratic Party lamented in an interview in April 2005 that: “Some financial investors never think about the people whose workplaces they destroy – they remain anonymous, faceless, descend like swarms of locusts on companies, strip them bare and then move on again.”

They still have their critics, even today – for example, in the study published in January by the Hans Böckler Foundation on how companies owned by private equity firms develop in Germany, which focused on the negative trend of equity capital ratios and number of employees at multiple companies across all industries that had been bought by private equity firms since 2013.

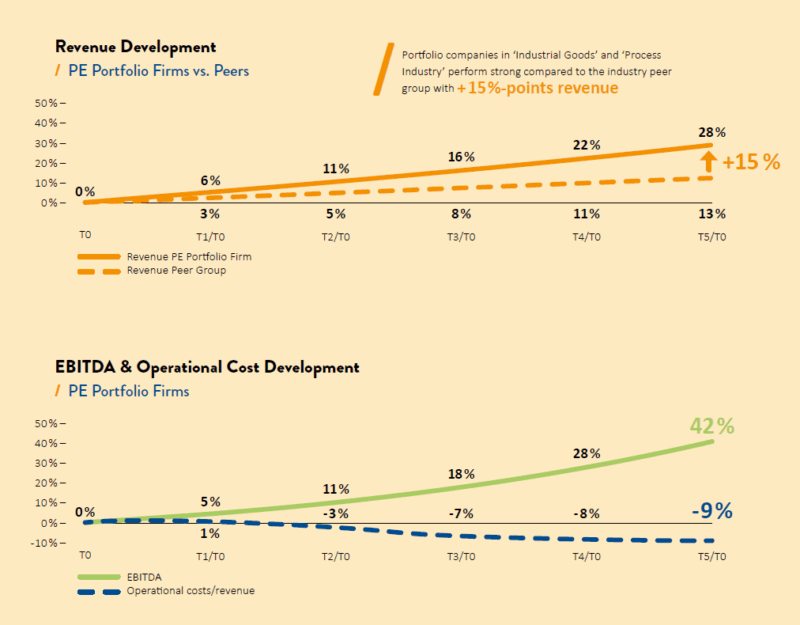

We have found that these results do not apply to portfolio companies in the industrial goods or process industries, as they experienced a significant increase in value in the first five years after being acquired. Portfolio companies achieve more than twice the EBITDA and revenue growth compared to companies from these industries without PE participation.

This observation applies across the full five years and the gap widens from year to year. For example, the sales of portfolio companies grow by an average of 28 percent during the period under review, while companies without PE participation achieve 13 percent. The difference for operating profit (EBITDA) is even graver, with portfolio companies achieving 42% growth and other companies having to settle for 9%.

If we compare the number of employees, here, too, the portfolio companies are ahead: their headcount is growing faster than that of their sector peer group, at 12 percent compared with nine percent. The only time we saw staffing levels fall was when we restricted the analysis parameters to portfolio companies where the focus was purely on restructuring.

Costs down, profit up

The disproportionate growth in EBITDA relative to revenue identified at portfolio companies – 42 versus 28 percent – demonstrates that gains are being achieved not only through accelerated revenue growth, but also through improved cost efficiency. In contrast, profitability in companies without a private equity stake falls as sales rise: while the rise in sales is 13%, the growth in EBITDA is just 9%.

A closer look at costs reveals that private equity firms start optimizing costs soon after they acquire a company. The focus here is specifically on other operating expenses, relating to indirect demands such as facility management, IT and marketing expenditure, and so on. A significant reduction in other operating expenses is already visible from the second year (T2) after the acquisition of a portfolio company. Within five years, other operating expenses fall by an average of nine percent. This optimization is a significant factor in the disproportionate growth in EBITDA.

from short-term supplier savings to holistic strategies for the various product categories

and bundling global demand across locations

or re-specifying requirements

at product level to continuously track price trends

for products with a high proportion of raw materials

The most successful almost double their operating profit

We can see notable differences within portfolio companies when it comes to material costs. On average, the material costs per unit produced remain stable, while the most successful portfolio companies achieve a growth in EBITDA of 94% by also reducing their material costs on an ongoing basis – by up to 8% within five years.

Private equity firms drive cost optimization to create a sustained increase in value across their portfolio companies. The most successful ones take innovative and complex approaches to Procurement, while also investing in digital solutions such as spend analytics tools and process automation.

By subscribing to our newsletter, you will receive the current issue of our customer magazine Supply Management Insights three times a year: