Being proactive on tariffs doesn’t just reduce risk – it creates competitive edge

The Ripple Effects Executives Aren’t Seeing Yet

Tariffs have emerged as a central issue in global trade policy, with expected ripple effects across nearly every industry. While the direct financial implications of importing goods are becoming clearer, the broader impact on supply chains remains largely unknown — and it is evident that the operational and financial impacts will run far deeper than the immediate costs.

Both BCG and Bloomberg have noted a marked uptick in tariff mentions by CEOs in 2025, reflecting the heightened uncertainty executives are navigating (Bloomberg x BCG CEO Radar Q3 2025). While there has indeed been a rise in focus and concern, our deeper review of expected impacts shared by U.S. companies shows a more conservative view — with most executives signaling limited effects on their near-term performance.

To help us better understand executive sentiment and actions surrounding tariffs, we analyzed the most recent earnings call transcripts from U.S.-based Fortune 500 companies. Using AI-assisted methods, we were able to synthesize the earnings discussions and found that most executives are sharing externally that they anticipate only limited impacts from tariffs and expressed confidence in their supply chains.

We believe some executives may not be fully accounting for – and should prepare for – the hidden second- and third-order impacts of tariffs. In fact, we are already seeing substantial effects in certain industries, and even uneven impacts between companies within the same industry. These knock-on effects should not be underestimated — they are real, and they require thoughtful consideration. Examples include supply chain bottlenecks driving up inventory carrying costs and increased cost of living accelerating wage growth.

Executive Sentiment on Tariff Impacts

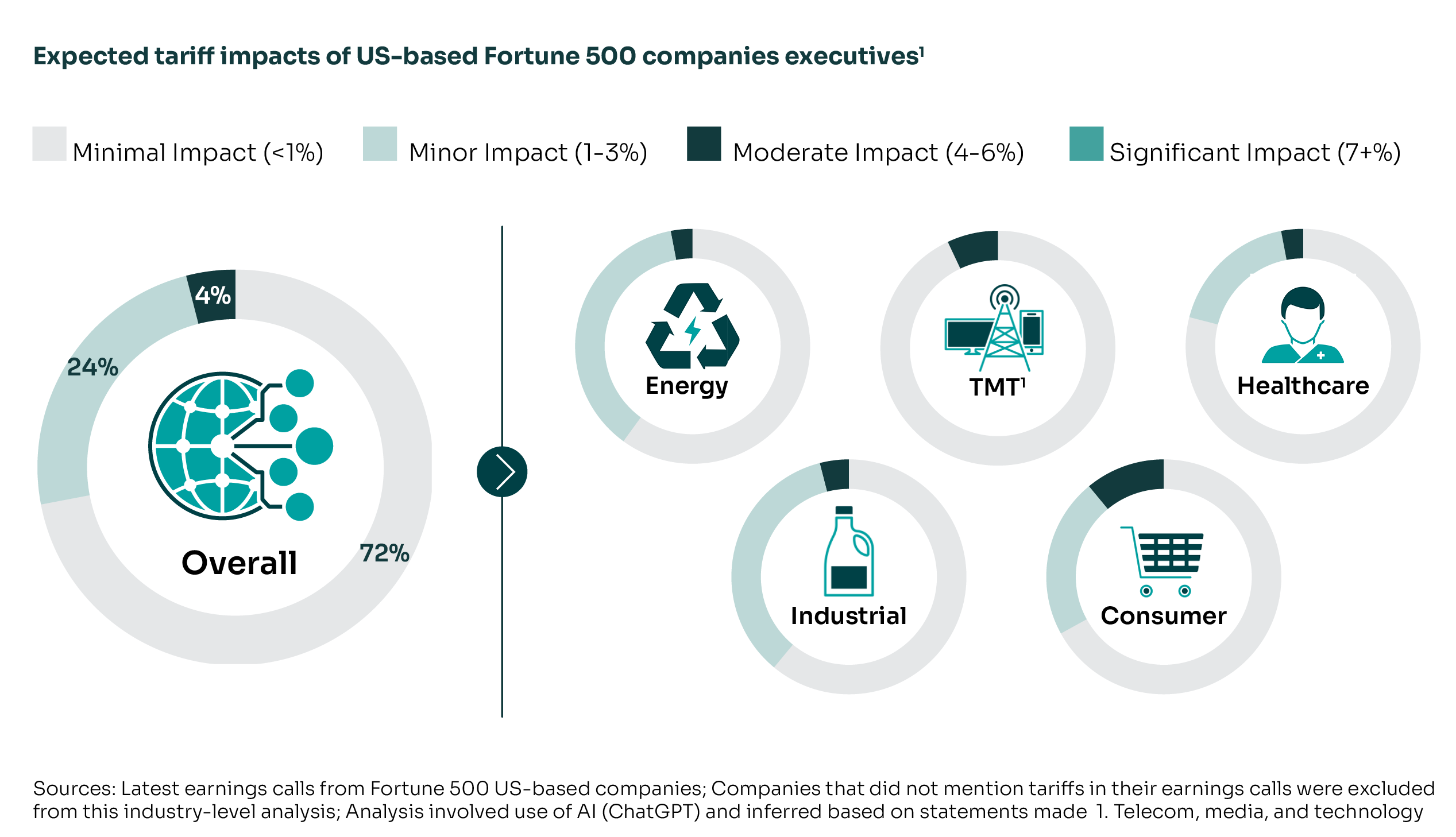

In our review and AI-based analysis of recent earnings call transcripts from top US-based Fortune 500 companies, executives appear to be broadly signaling that they expect tariffs will have a limited financial impact on their businesses. They’ve tended to leave investors with two messages: they do not believe the impacts will be significant or have already taken appropriate steps to mitigate exposure (e.g., domestic sourcing, supply diversification, operational agility). This optimism has reassured markets, with many leaders pointing to strong supply chain fundamentals and strategic partnerships as evidence of resilience. As shown in Figure 1, most executives expect no more than a 3% impact to their business, with the Consumer sector emerging as a slight outlier and bracing for a higher degree of impact.

// Figure 1: Earnings call indications of tariff impact expectations for US-based Fortune 500s

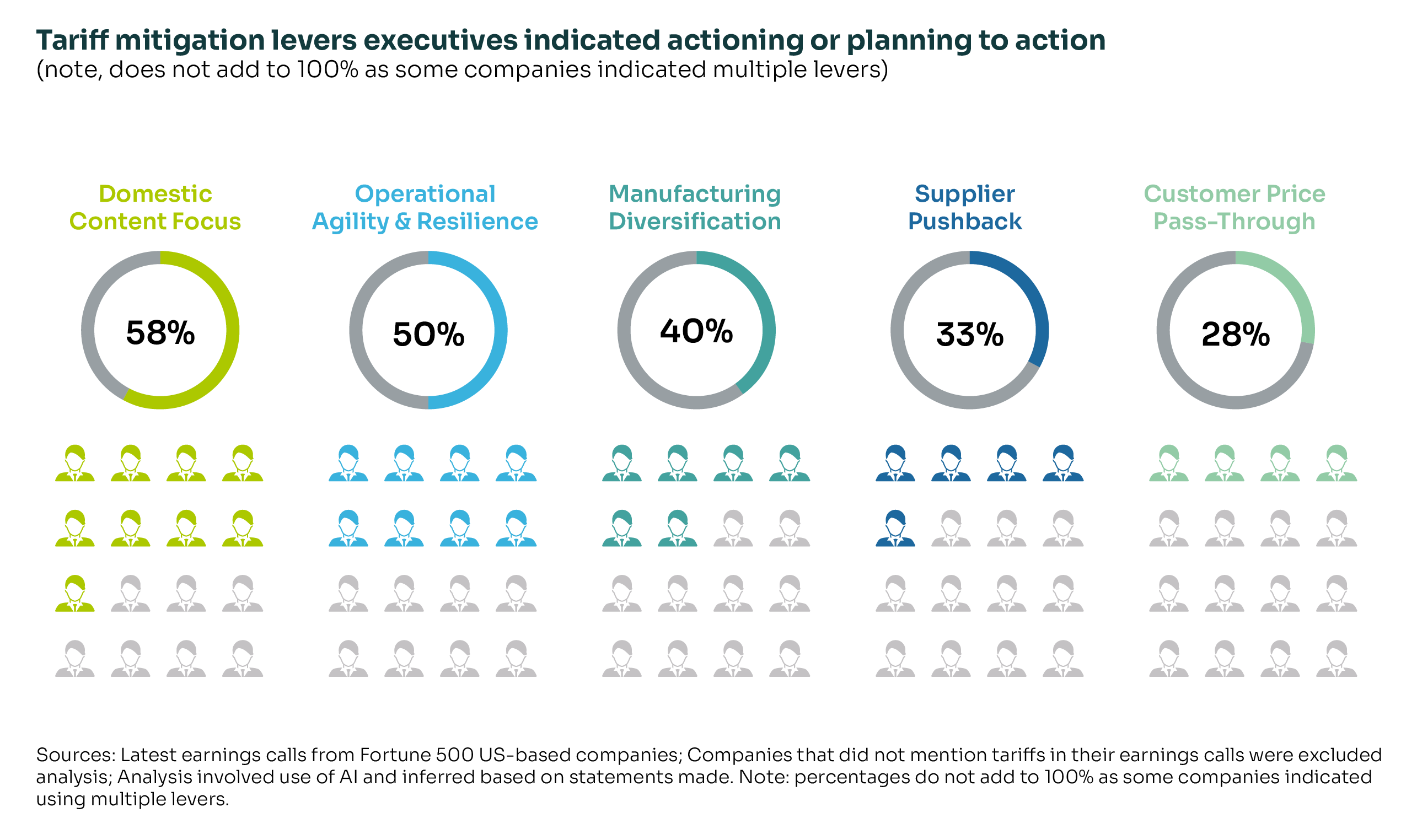

We also looked at the top procurement and supply chain-related levers executives cited using (or planning to use) to help mitigate the impacts of tariffs. The top three levers stated were domesticating content, building supply agility, and diversifying manufacturing locations. Figure 2 (below) highlights the most common levers cited by executives and the % of companies who cited using that lever – many of whom stated using multiple levers.

// Figure 2: Tariff mitigation levers executives indicated having actioned or planning to action

Hidden Costs & Implications of Tariffs

While many executives view tariffs as a manageable challenge, it is important to recognize that the true effects often extend beyond the most visible, immediate costs. In addition to the direct duties on imported goods, there are broader ripple effects that can emerge within supply chains and across the economy.

![]()

Domestic Content ≠ Domestic Origin

Many “assembled in U.S.” parts still rely on foreign subcomponents that will impact underlying cost structures

![]()

Domestic Labor Rates Will Likely Increase

Cost-of-living and inflation will accelerate increases in domestic craft labor rates which suppliers will pass on

![]()

Anticipatory Price Hikes Starting

We’re seeing signs of suppliers already requesting pre-tariff increases to get out in front of exposure (e.g., MRO supplies)

![]()

Pricing Agreements Not Always Enforced

Suppliers often override or ignore price lock mechanisms when there are major market changes

![]()

Change Orders Often Go Unchecked

Without tight controls, companies accept mid-project change orders which risks allowing tariff impacts through

![]()

Domestic Demand Will Likely Spike

Near-term shift to U.S. suppliers will outstrip supply, which is likely to drive prices up domestically as well

![]()

Suppliers Passing Through All Risk

Vendors are embedding tariff clauses or switching to index-based pricing allowing them to pass costs on to customers

![]()

Delayed Rate Recovery Hurts Cash

Tariff costs hit upfront; however, regulatory recovery lags are likely to impact near-term liquidity

// Figure 3: Top risk factors and hidden costs observed and expected

Two Deep Dives into Hidden Cost Dynamics

One of the most likely hidden costs is that domestic content does not always mean domestic origin. A product assembled in the United States may rely on key parts from abroad. When buyers lack line of sight beyond tier 1, suppliers have an opportunity to claim tariff pass throughs that exceed their true exposure. Buyers ability to challenge and pushback on suppliers is difficult without visibility into where subcomponents come from and what percent of the overall cost they account for.

This problem grows when contract terms are unclear or not enforced. For example, a recent dispute between a tier-1 supplier and tier-2 supplier over price increases from raw materials cost pass-throughs led to halted shipments and caused significant risk of paused production for a major automotive OEM.

Domestic wages are the other pressure point. Higher living costs can lift domestic pay, and many companies rely on contingent labor under multi-year rate cards with automatic price escalators. In uncertain markets, vendors often take a conservative position and propose escalators that are well above the actual wage inflation – many time cherry picking job types with the fastest increases and treating them as “typical” to justify the increase. Companies then face both internal payroll pressure and outsized asks from external providers unless they have the right mechanisms in place to challenge and hold suppliers accountable.

These hidden costs that are especially important to monitor, manage, and mitigate through protective actions to dampen the potential inflationary impact of tariffs. In practice, what may sound like a minor headwind in earnings calls can often translate into meaningful margin pressure at the operational level. Procurement teams must be ready to confront these dynamics swiftly and directly.

What Leaders Can Do To Prepare & Take Action

To address these hidden costs, leaders must go beyond reactive measures and adopt a structured, forward-looking response. Procurement teams cannot afford to wait until tariffs show up in quarterly earnings; by then, mitigation opportunities may be limited and cost increases already embedded in the business through long-term supplier contracts, or pricing commitments made without tariff contingencies.

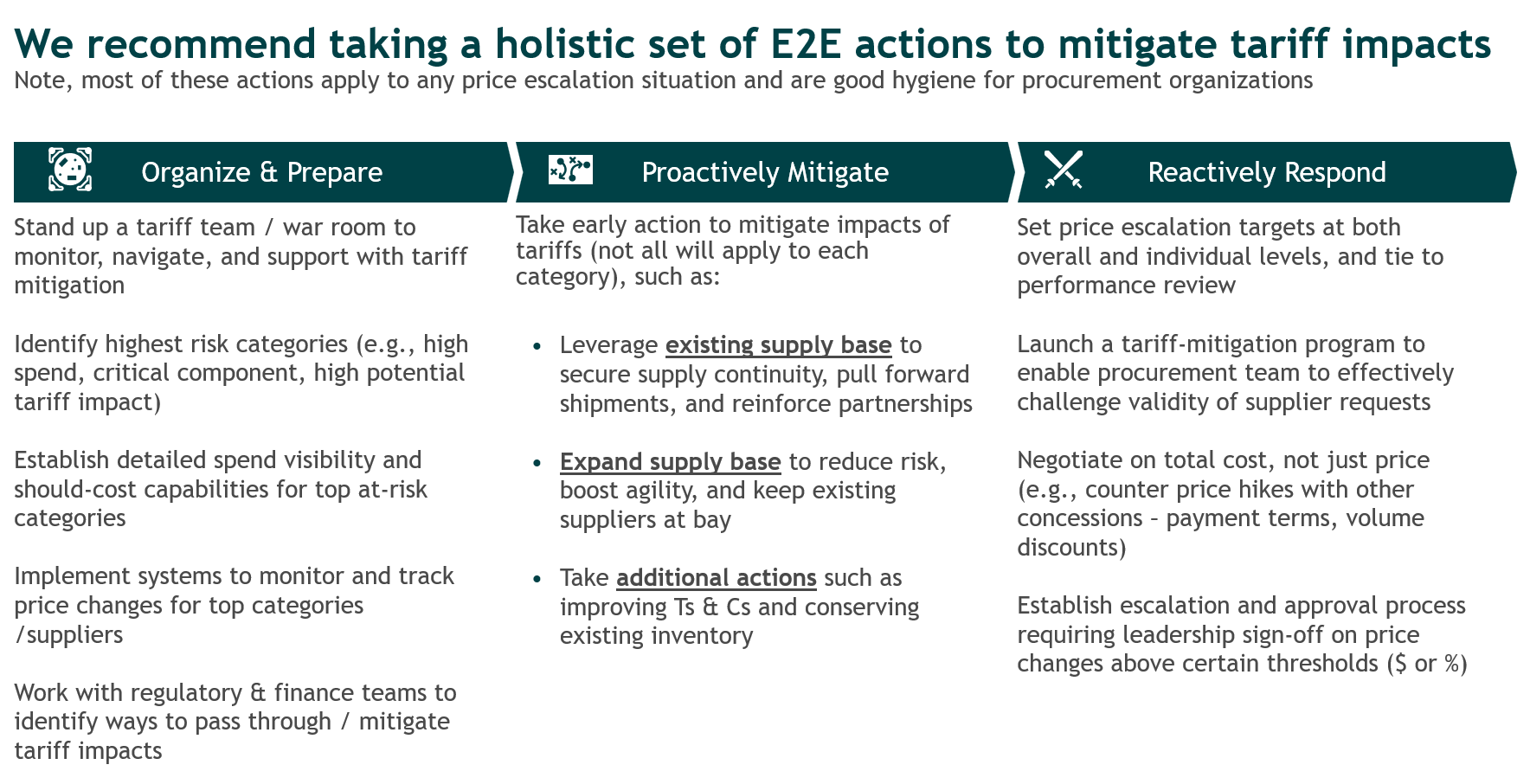

Our recommended approach for action has three parts: Organize & Prepare, Proactively Mitigate, and Reactively Respond. These actions should be embedded in the operating rhythm of procurement, so that when the impact of tariffs begins to materialize, the organization can pivot with speed and confidence. See Figure 4 (below) for key actions recommended at each step.

// Figure 4: Holistic set of E2E actions companies can take to mitigate tariff impacts

There are companies already demonstrating the value of this proactive approach. For example, a U.S.-based battery retailer, proactively diversified its sourcing footprint in response to earlier tariff waves. The company cut its reliance on Chinese imports from 32% in 2018 to just 4% by 2025 by shifting more sourcing to the U.S., Vietnam, and Malaysia. This early move helped the company absorb new tariff hikes — some as high as 145% — without sacrificing quality or flexibility, while keeping costs stable and investors confident. The takeaway: being proactive on tariffs doesn’t just reduce risk, it can create a lasting competitive edge.

Some leaders may still ask, “How can I justify putting resources toward preparation when the future is so unclear?”. While some uncertainty still exists, tariffs and trade restrictions are unlikely to fully disappear, and are here to stay in one form or another.

This makes the case for preparation even stronger. Even if specific tariffs shift or fade, nearly all actions in our playbook represent sound procurement practices that strengthen resilience and create value regardless of how trade dynamics evolve over time. For example, training buying teams to handle supplier price increases through a structured process — backed by spend analytics, should-cost models, scripts, and clear escalation workflows — builds capabilities that extend far beyond tariffs. The result is a more agile procurement function that is not only equipped to manage tariff-related risks but also resilient against a wide range of cost pressures.

How can I justify putting resources toward preparation when the future is so unclear?

We would like to thank our global team of cross-functional BCG and Inverto experts that contributed to the research and writing, including:

Ben Kim, Hansika Gupta, Margarita Shmatova, Callum Phillips, Stephane Crosnier, Jan Mersmann, Sarah Lichtblau, and Clementine Desigaud.

Further Insights