- Transition to EVs often essential part of corporate commitments to achieve Net Zero

- High interest rates and technological limitations making transition even more challenging

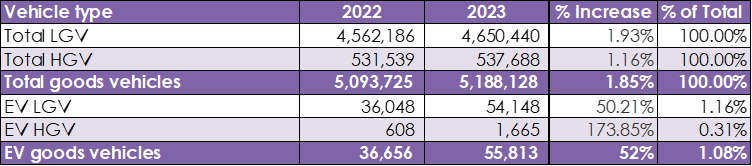

December, 19th 2023. Only 1% of vans and lorries in the UK – 55,813 out of a total 5,188,128* – are electric vehicles (EVs), shows research by supply chain experts Inverto, a subsidiary of Boston Consulting Group.

Kiren Pandya, Senior Project Manager at Inverto, says: “That only 1% of vans and lorries are electric highlights the sheer scale of the challenge of decarbonising fleets.”

“Five million logistics vehicles is a huge number to replace – either with electric equivalents or lower-cost alternatives like bicycles in cities. This will create severe supply-side bottlenecks.”

The vast majority of electric commercial vehicles in the UK are Light Goods Vehicles (LGVs) like vans, with only a small minority being Heavy Goods Vehicles (HGVs) like lorries (see table below for breakdown).

The number of electric vans and lorries is growing – with a 52% increase in the past year – but the gap is too big to close soon. The high cost of switching to EVs is making decarbonising logistics a major hurdle for supply chains.

High interest rates are making the already-expensive transition to EVs even costlier. Inflation in the cost of raw materials – and in turn EV batteries – is also further increasing costs.

Says Kiren Pandya: “Electric vehicles have always been more expensive than those with a combustion engine – and that’s especially true of electric vans. Interest rate rises are making it more expensive for fleet operators to borrow and this is impacting their ability to lease electric vehicles.”

The recent expansion of the ULEZ in London has increased costs for fleet operators. This has added further pressure to fleets to transition to electric alternatives at a time when EVs are particularly expensive. Instead of buying new EVs, some companies are simply moving vehicles geographically within their portfolio, bringing all their EVs into London and taking non-EVs outside of London.

A huge technological gap remains for long distance HGV EVs, with current battery range not able to compete with fossil fuel equivalents. This technological gap is further hampered by a lack of long-distance charging infrastructure.

Shortages of key components like high-voltage cables (due to competing demand from expanding broadband infrastructure) and skilled workers make expanding the UK’s charging infrastructure even more complicated.

Says Kiren Pandya: “Lorries are simply too heavy and travel too far for this section of the supply chain to be decarbonised. Until the capacity of electric batteries allows lorries to travel further and charging stations are as ubiquitous as petrol stations – including improving speed to recharge the batteries, this leg of a product’s journey will remain hard to decarbonise.”

“Fortunately, the bulk of freight emissions are in the final leg of transportation – with vans – which is far easier to achieve emissions reductions in. That is why we advise our clients to first focus their efforts on decarbonising their last-mile distribution networks.”

Companies are also increasingly making of use of low-cost alternatives to supplement the switch to EVs. Recycling tyres and parts is now another major way that companies are finding affordable emissions savings.

Says Kiren Pandya: “We’ve achieved huge emissions savings for our clients by simply reducing waste. Reusing functioning car parts and switching to more fuel-efficient tyres is making a huge difference.”

“We’ve also had great success with ‘old school’ solutions – increasing the use of bicycles and e-bikes for city-centre logistics can reduce last-leg emissions to near-zero.”

EV goods vehicles rising fast but still just 1% of the total in the UK

*Year end: March 31 2023

About Inverto

As an international management consultancy, Inverto is one of the leading specialists in strategic procurement and supply chain management in Europe. The consultancy supports companies from strategy development to implementation and accompanies them in the digitalization of procurement. As a subsidiary of the Boston Consulting Group, Inverto identifies and realizes the potential for process optimization and cost reduction for its clients and supports the establishment of resilient supply chains that meet sustainability criteria. In comprehensive transformation projects, Inverto is the trusted partner for improving the performance of the procurement organization.

Inverto has over 500 employees in 14 locations in 11 countries. The diverse, international teams have in-depth expertise in various industries and functions. Clients include international corporations and mid-sized companies across all industries, as well as the world’s leading private equity firms.

For more information, please visit www.inverto.com/en/