Electricity utility companies are at a pivotal moment of challenge and opportunity. Concerns about the looming cable supply crunch are being intensified by a multitude of demand- and supply-side factors. Discover below our resilience framework for electricity utility companies – emphasizing high-impact levers that can be used to ensure supply stability, cost-efficiency and, strengthened partnerships in today’s volatile markets.

The indispensable role of cables: Powering modern society

Electrical power cables within grid networks are foundational to modern economies and society. As the developed world looks to achieve carbon neutrality – with the EU targeting a 42.5% share of renewable energy by 2030, while the UK strives for 100% carbon-free electricity by 2035 – cables are essential to the seamless flow of clean electricity. Given the targets and the energy trilemma, electricity utility companies must urgently secure future cable supplies.

With a strong trend towards sustainability, there are an ever-increasing number of renewable energy projects. In turn, that’s increased the demand for power cables exponentially. The high-voltage (HV) cable market, alone, has grown by 22.6% in the last year. Yet, there’s a major lack of supply, which is creating significant challenges.

Indeed, numerous projects have already been postponed:

- In the US, a major Nordic renewable energy company has abandoned two offshore wind projects due to supply chain challenges and a lack of available critical equipment. With a combined planned capacity of 2,248 MW, these would have powered over 1.5m homes a year.

- The UK faces similar challenges. According to BBC estimates, there are over £200 billion worth of projects waiting to be connected to the grid. That’s despite a commitment to 100% carbon-free electricity by 2035, according to the sixth Carbon Budget. Leading energy companies have been told that some connections may take up to 15 years, far beyond that target.

Failing to address these bottlenecks raises environmental and financial concerns. Every delay intensifies the already critical climate crisis, adding strain to global sustainability efforts. Meanwhile, utility companies risk penalties, diverting funds away from investment in renewable energy. Such companies stand at a decisive crossroads. It’s imperative they can secure the cable necessary to develop, strengthen, and grow their networks.

A global phenomenon: The unseen crisis in electricity transmission and distribution

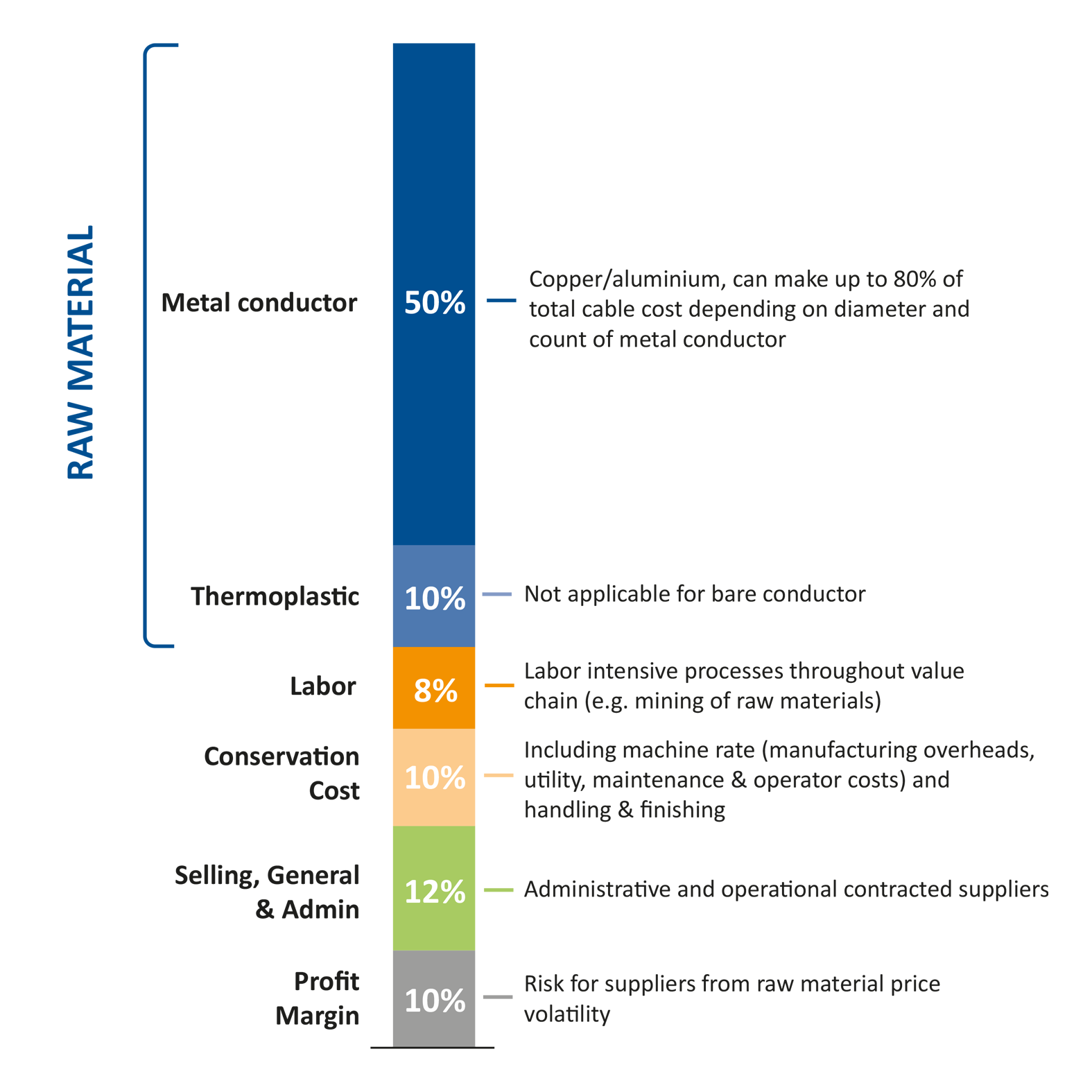

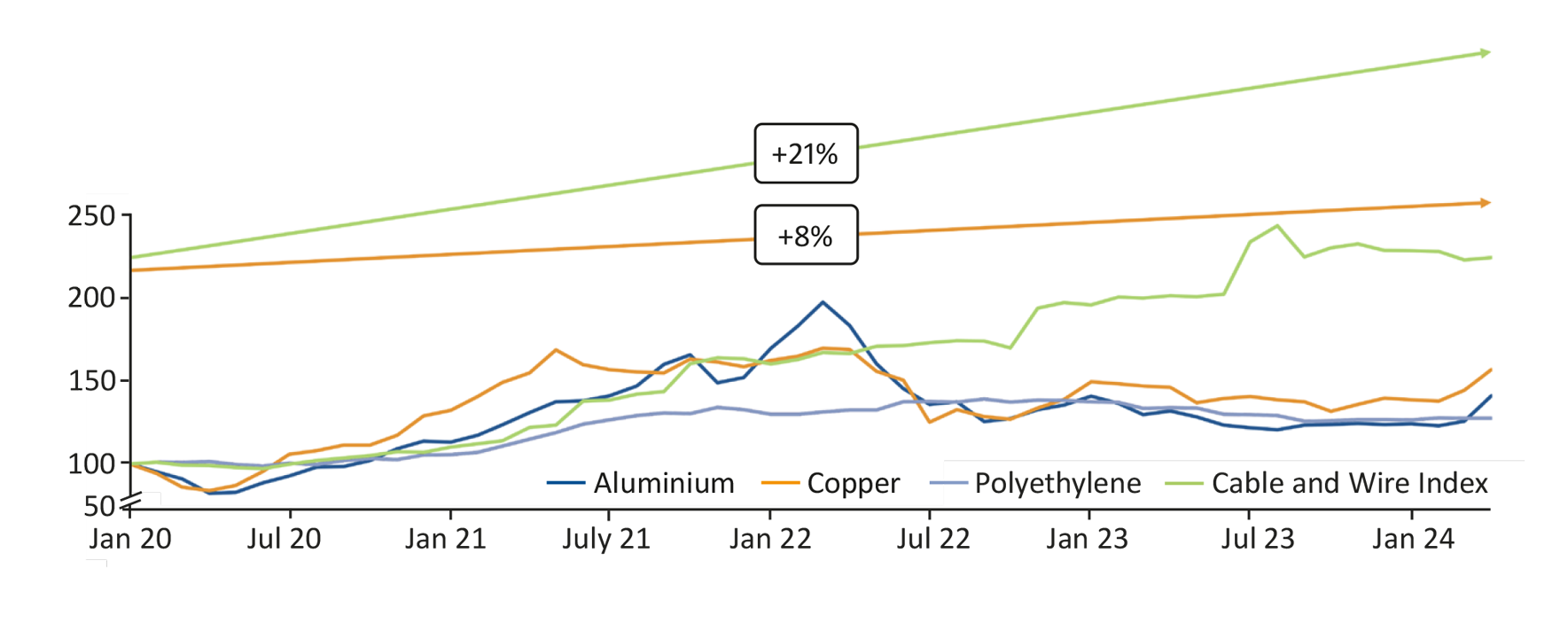

Various sectors are experiencing rising demand for critical raw materials needed in cable production. Industries such as automotive, telecommunications, and digital infrastructure will continue to compete for these resources. Although we have seen a relative increase in raw material prices of nearly 8% over the last four years, average end-product prices have surged by 21% in the same period, as illustrated in Chart 2. This difference results from supply failing to meet demand, leading to higher profit margins for cable manufacturers. This is evidenced by their growing EBIT (Earnings Before Interest and Taxes) and expanding order books.

// Chart 1: Average cable and conductor type total cost breakdown

Source: Beroe advantage procurement category intelligence on cables (June 2023)

// Chart 2: Cable, conductor, and raw material indexed prices development (2020-2024)

Source: Inverto analysis and FRED indices (April 2024)

The cable supply crunch: A dual-sided dilemma

The decoupling of price and cost has been driven by a range of supply and demand factors.

- Technological advancements: The rise of 5G technology and the electric vehicle revolution have boosted demand for cable.

- Ageing infrastructure: Approximately 75% of US transmission lines need replacing – at a projected cost of around $700billion. Europe also needs vast amounts of cabling to upgrade infrastructure from the 1940s and 1950s.

- Rapid urbanization: Emerging markets – particularly Southeast Asia and Africa – are making major grid expansions, with plans to significantly boost grid capacity over the next decade.

- Renewable energy integration: Renewable sources, such as wind turbines, require 3-4 times more cables on a per MW basis than conventional sources.

- Labor constraints: The global market faces a severe skills gap in manufacturing. The US potentially needs more than

2.1 million skilled workers by 2030. The UK’s job vacancies hit a record 1.3 million in early 2022 and remain high, albeit below

1 million since August. - Slow factory capacity ramp-up: It takes 2-3 years on average for a cable factory to become fully operational, due to extensive testing requirements.

- Volatile raw material prices: A surge in aluminum and copper prices, which make up roughly 50% of the total cost. Other factors – such as China’s demand resurgence and competition with other industries for resources – are projected to elevate copper prices from the current $8,400 per ton to $15,000 by 2025.

- Geopolitical instabilities: The China-US trade tensions have added complexity to the industrial goods sector. The US Chamber of Commerce says they’ve inflated imported goods’ costs by 12%, straining an already burdened supply chain.

Major cable manufacturers predict they will soon run out of capacity. High Voltage Direct Current (HVDC) cables are particularly at risk – with significant constraints through to 2030 and beyond. Inverto forecasts that this demand-supply gap will endure. Market analyses – with macroeconomic and geopolitical factors – predict that demand will outstrip supply by a margin exceeding 6% over the next five years.

Given these projections, it’s imperative that utility companies develop resilient strategies that can adapt to and exploit the evolving market dynamics.

In this volatile landscape, how can electricity companies secure reliable cable supplies while optimizing costs?

Prioritize relationships with suppliers who have a proven global scale and adequate capacity. For example, energy company Enel has partnered with Prysmian Group, a major manufacturer, to supply cables for renewables projects.

Utilize upfront payments and volume commitments as a strategy for securing long-term supplies. Leading supplier of wind power solutions, Siemens Gamesa, reached a long-term agreement with the Prysmian Group – by making commitments through volume contract – that has ensured a continuous supply.

Where feasible, purchase directly from Original Equipment Manufacturers (OEMs) – rather than distributors – to streamline procurement. Telecommunications provider, Verizon, signed a direct agreement with OEM, Corning Incorporated, to ensure a steady supply of optical fiber cables.

Invest in long-term partnerships with key suppliers – beyond mere transactional relationships. For example, Ørsted and Eversource have formed a strategic collaboration with Nexans for the production of domestic sub-sea cable – from a $220 million facility expansion in South Carolina that’s created 160 new clean energy jobs.

Collaborate with suppliers over critical components – such as cable specifications – to help optimize network performance and achieve cost benefits. For instance, the Saudi Electricity Company (SEC) standardized its high-voltage cable designs – across various voltage ratings – working closely with its cable suppliers.

What’s next: Anticipating the impact of cable supply challenges

Cable supply is poised for major transformation. Emerging technologies – such as sustainable cables and onshore HVDC systems – offer promising efficiencies over traditional cabling. Additionally, the rise of smart grids and the Internet of Things (IoT) will revolutionize electricity transmission, potentially reducing dependency on traditional cabling. However, such innovations also introduce new challenges – from cybersecurity risks to regulatory issues.

Leading cable suppliers are moving towards sustainable production:

- Global power cable provider Nexans has committed to reduce CO2 emissions using 100% low-carbon aluminum and 50% recycled plastics for insulation and jacketing.

- Cable manufacturer NKT has – in a groundbreaking collaboration with suppliers and customers – started employing low-carbon copper in its 320kV HVDC cable – a world first.

- Many other industry peers are also championing sustainability-driven initiatives – including Sumitomo, LS Cable, Furukawa, and more.

These efforts will all contribute to reduce CO2 emissions and promote more efficient resource utilization and sustainability. By emphasizing recycling – especially costly scarce metals – these suppliers will optimize waste versus production.

Meanwhile, Asian and South American suppliers are emerging as key global players. Countries like Vietnam, China, South Korea, and Mexico are ramping up supply. These will be important sources for the future, especially for utilities that invest early and secure production volumes now.

In this changing world, it’s imperative that utility companies be proactive and truly understand their supply chains. They should pinpoint critical supply markets, both globally and regionally, and foster resilience by collaborating closely with suppliers. Fortifying these relationships and becoming a ‘customer of choice’ offers huge strategic advantages.

Find out more about the energy industry

Authors: James Manton and Marwan Fathalla, Senior Consultants at Inverto

Get in contact with our energy experts

More insights from the energy industry