- Rapid rise in costs pushing many companies into insolvency

- Not all of those increases in costs have been justified

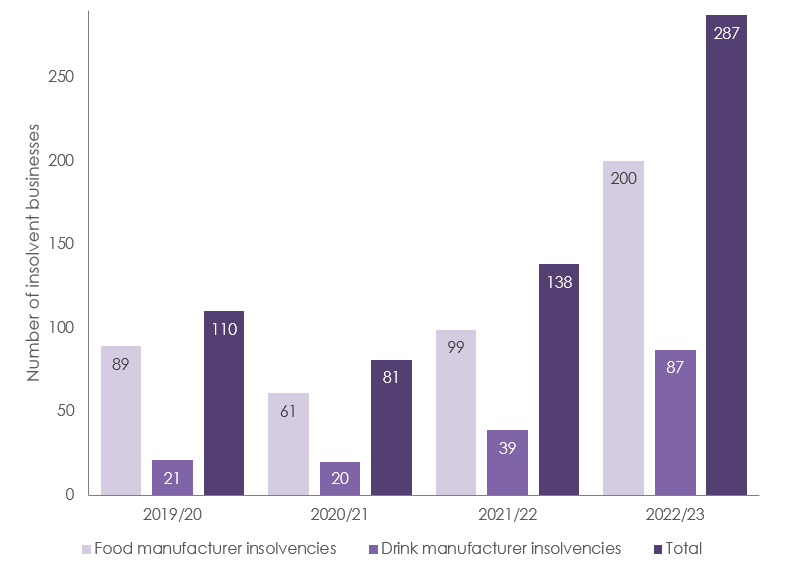

LONDON, September 8th 2023. The number of food and drink manufacturing companies entering insolvency has increased by 108% to 287 in the year to the end of June 2023, compared to 138 the previous year says international procurement and supply chain management consultancy Inverto, part of Boston Consulting Group.

Food and drink companies have struggled with significant inflation of supply costs, which have eaten into their profit margins. The costs of ingredients rose dramatically in the wake of the Ukraine crisis, particularly grains, cereals and products requiring significant fuel outlay to source – e.g. seafood.

With weakened profits, many businesses struggled to service debts as interest rates rose.

Drink manufacturing companies saw a 123% surge in insolvencies, from 39 in the previous years, to 87 in the past 12 months. Food manufacturing companies have had a comparatively difficult year, with a 102% increase in insolvencies, from 99 in the previous year, to 200 in the year just gone.

Mohamad Kaivan, Managing Director at Inverto, says that as price deflation is now beginning to occur, food and drink manufacturing companies should be renegotiating prices down with suppliers. Notably, the prices of ingredients for many manufacturers like dairy products and flour have fallen – however, those price reductions will not help food manufacturer margins until they ensure those price reductions are passed on to them.

Kaivan adds that food manufacturers should ask their suppliers for greater transparency over their costs. Understanding the structure of their suppliers’ costs can help procurement teams to negotiate fairer prices and accept pain sharing if necessary.

Additionally, businesses that secure ‘customer of choice status’ with their strategic suppliers can benefit from greater protection in times of scarcity.

Kaivan continues: “The year has seen a sharp rise in food and drinks manufacturers suffering from financial distress caused almost exclusively by their suppliers demanding price rises. Some of those price rises have been justified but a lot of those price rises haven’t.“

“While businesses should look to take advantage of decreasing prices, they also need to be preparing for future risks that could potentially impact their businesses. This often requires a rethink of their strategies and ways of working with their suppliers to ensure they can improve their future resilience to potential supply shocks.”

About Inverto

As an international management consultancy, Inverto is one of the leading specialists in strategic procurement and supply chain management in Europe. The consultancy supports companies from strategy development to implementation and accompanies them in the digitalization of procurement. As a subsidiary of the Boston Consulting Group, Inverto identifies and realizes the potential for process optimization and cost reduction for its clients and supports the establishment of resilient supply chains that meet sustainability criteria. In comprehensive transformation projects, Inverto is the trusted partner for improving the performance of the procurement organization.

Inverto has over 500 employees in 14 locations in 11 countries. The diverse, international teams have in-depth expertise in various industries and functions. Clients include international corporations and mid-sized companies across all industries, as well as the world’s leading private equity firms.

For more information, please visit www.inverto.com/en/