Due diligence operativa per un importante investitore di private equity

Investment decision support in the packaging sector

Our client is an american private equity firm, which invests worldwide mainly in manufacturing companies. At the start of the project, the company was on the verge of acquiring a packaging manufacturer.

Private Equity

Objective: Determination of the maturity level and identification of potentials.

We were commissioned to support the operational due diligence. The main objective of the project was to assess the procurement organisation, determine its maturity and analyze it for unused potential.

Approach: “Outside-In” view with the help of experts

In order to be able to realistically evaluate synergies and potential savings when taking over the investment target, our consultants first created a transparent database. We subjected the company’s procurement data to a plausibility check and validated it through interviews with experts for specific raw material groups and with the buyers of the investment target. In this way, we obtained a comprehensive overview of all factors important for the valuation.

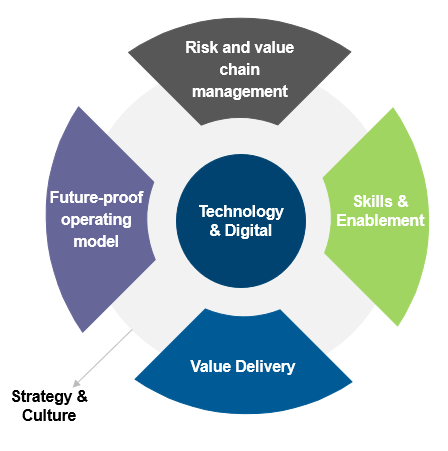

The assessment of the maturity of the procurement organisation from an “outside-in” perspective was based primarily on these interviews. Using the INVERTO Maturity Quick-Check, we collected the relevant information and then compared it with industry benchmarks. Using our performance benchmark tool e-map, we were able to map the performance and maturity of procurement in six dimensions. The investment target was already well positioned and could keep up with the industry standard in most dimensions. In other areas, we identified potential for improvement, in some cases considerable.

In the next step, we analyzed the investment target’s procurement strategies, conditions and supplier contracts and calculated the savings potential. The focus here was on the procurement of raw materials that the company processes in its packaging. Overall, long-term, raw material-market-adjusted savings potential of four percent was identified. In order to realize this high potential for a purchasing volume that is heavily dominated by raw material costs, it was crucial to detail the largest unused levers.

One of the levers also focused on optimizing the working capital management of the packaging manufacturer through supply chain finance and reverse factoring.

To ensure that the potential can be realized upon takeover, we drew up a long-term implementation plan. Very centrally, the ramp-up of savings was modeled using the right levers and resulting measures.

Result: Due diligence decision template

- Assessment of the procurement maturity level

- Analysis of savings potentials including “ramp-up” scenario

- Elaboration of implementation plans

- Definition of the most important optimization levers

- Improvement of cash flow

Get to know our experts