Resilience brings significant benefits

Risk reduction

With a resilient supply chain, companies are better prepared for unforeseen events such as natural disasters, political instability, raw material shortages or supplier insolvencies. Reducing vulnerability to such risks leads to greater business continuity.

Adaptability

Companies with a resilient supply chain can respond more quickly to market changes and guarantee uninterrupted service to their customers – even in the face of disruptions to certain parts of their supply chain.

Cost reduction

Efficient planning and resource allocation enables companies to use resources effectively.

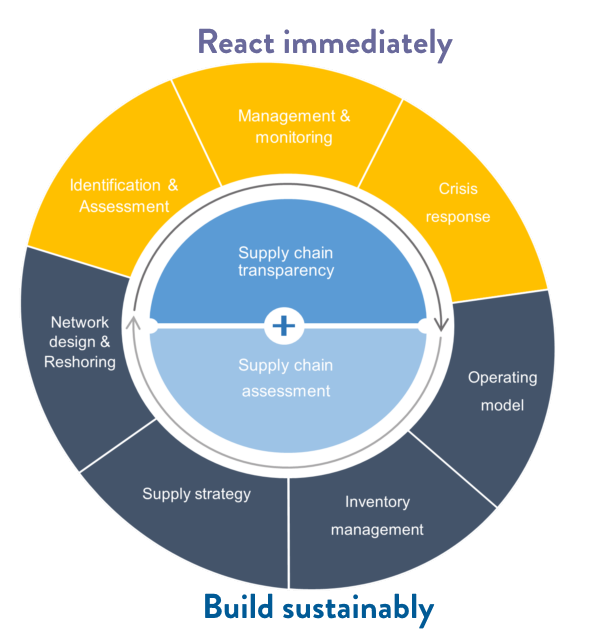

Framework: Resilience in the Supply Chain

A supply chain designed with resilience in mind can compensate for unexpected events and crisis situations. That’s because there’s usually more than one supplier available for a product, and because alternative – and proven – means of transportation can be used if necessary. Supply chain resilience also means that warehouses are set up in a cost-optimal way to always have adequate stock on hand, and to distribute individual commodity groups appropriately across different locations. These solutions can be leveraged during times of positive economic activity to accelerate growth and expansion.

We distinguish between immediate crisis response and sustainable restructuring for greater resilience in supply chains.

For immediate response, we include:

- Establishing transparency in the supply chain

- Identifying and assessing risks

- Developing predefined processes for crisis response.

Sustainable further development of the organization entails:

- Further development of the operating model

- Implementation of data-based warehouse management

- Development of resilience-focused supplier management

- Data-based mapping of the complete supplier network, identification of risks and countermeasures

Further Supply Chain Resilience topics

Risk management

By taking an active role in responding to crises, we support our customers more effectively. That’s both in establishing their proactive risk management after the acute phase or – depending on requirements – in further developing it.

Reshoring and Nearshoring

Identifying and qualifying regional partners can be an important step in making supply chains resilient. We work alongside our clients to assess the availability of suitable suppliers within a defined radius, as part of reshoring and nearshoring initiatives. Moreover, we also provide support in approaching them, negotiating with them and integrating them into the supply network.

Working Capital management

Optimizing working capital is crucial at the moment. High interest rates are causing cash flow strain and elevated post-pandemic inventory levels are affecting liquidity.

Get in contact with our experts